New property taxes laid out in BC’s recently unveiled 30-point housing plan are expected to dampen home sales and prices in the coming months, according to TD Economics.

The housing strategy, laid out in the government’s 2018 budget is meant to tackle eroding housing affordability and curb demand — particularly in the Lower Mainland.

Included in the plan is a new speculation tax, and a 5% increase to Metro Vancouver’s already existing foreign buyer tax. Both levies will apply to the majority of the province.

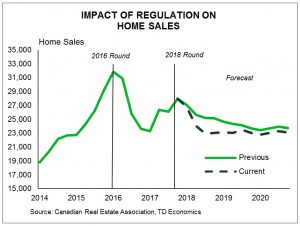

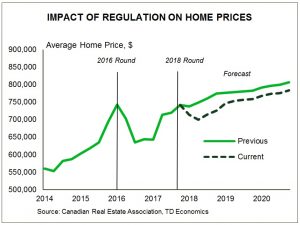

In TD’s Provincial Economic Forecast, published today, the bank’s economics team says the new regulations will cause peak-to-trough declines of 5% to 10% in home sales and 5% for prices.

However, the impact won’t be as notable compared to what occurred when new mortgage rules were introduced in 2016.

“The impact on housing activity will be more muted than in 2016 since the market is now in a more balanced position and the marginal increase in the tax is smaller,” reads the report.

TD bank adds that compared to the 2016 round of regulations, the impact on the current round on sales and prices will be around one-third.

As a result, TD has downgraded its 2018 forecast for both BC sales and prices to a year-over-year decline of 5.8% (previously down 0.6%) and an annual increase of 3.1% (previously up 7.2%), respectively.

In addition, TD cautions that there is uncertainty around the outlook of BC’s housing market, as the new regulations have been accompanied by a higher interest rate environment and a new national mortgage stress test, which are both also likely to weigh on market activity.

These 2 Charts Show How BC’s New Housing Plan will Weigh on Sales & Prices by Kerrisa Wilson | Buzz Buzz Home

Recent Comments