What happened to the hot spring market? Typically, the period between March and May is the busiest time for home sales, but that’s not the case this year, reports the Canadian Real Estate Association, as combined activity for those three months is the lowest in nine years.

Sales have remained flat across the country between April and May, down 0.1%. That’s a five-year low, says CREA, with year-over-year declines deepening to 16.2%, from the 13% gap recorded in April. The national home price has also declined 6.4% to an average of $496,000. While the MLS Home Price Index posted a modest 1% gain, it’s the smallest on record since 2009, and marks the 13th consecutive month of price deceleration.

Roughly 80% of all markets saw sales fall from 2017, with the greatest decreases in British Columbia and Ontario’s Greater Golden Horseshoe region.

CREA Says Stress Test Behind Slower 2018 Sales

That’s prompted CREA to update its sales and price forecast for 2018, pointing to the sustained impact from the mortgage stress test introduced this January. Guideline B-20 has been more effective at cooling the market than policy makers anticipated, says the association, and contributed to a rush of late 2017 activity that “pulled forward” sales that would usually occur in the first half of the year. As well, CREA’s analysts say the stress test’s impact has been exacerbated by today’s rising interest rate environment.

“This year’s new stress test became even more restrictive in May since the interest rate used to qualify mortgage applications rose early in the month,” says Gregory Klump, CREA’s chief economist. “Movements in the stress test interest rate are beyond the control of policy makers. Further increases in the rate could weigh on home sales activity at a time when Canadian economic growth is facing headwinds from US trade policy frictions.”

2019 Housing Market to Pick Back Up

CREA has downwardly revised its 2018 sale forecast by -11%, anticipating 459,900 homes will change hands this year, citing a combination of the stress test, housing market uncertainty, new housing policies, high home prices, and lack of supply. Prices are expected to remain moderately flat, to ease by 2.1% to $499,100. However, the national association emphasizes that decline is in aggregate, with most markets posting price gains in the months to follow. Much of the price decline will be due to fewer sales occurring in Vancouver and Ontario, it states.

However, CREA remains optimistic normal seasonal market conditions will return in 2019, with sales to rebound to 474,800 and prices rising 3.8% to $518,300.

Despite softer prices for the most expensive home types, condos continue to lead the market in terms of price growth, due to their comparable affordability, with gains of 12.7%, followed by townhouses at 4.9%. One-storey and two-storey single-family homes, however, are down by -1.5% and -4.7%, respectively.

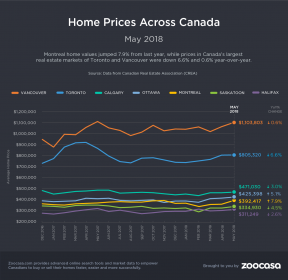

Home Prices Across Canada in May 2018

May 2018 Price Growth by Region

British Columbia : Prices continue to rise in the Lower Mainland, up 11.5% in Greater Vancouver, and a whopping 20.6% throughout the Fraser Valley. Victoria Island and the remainder of Vancouver Island each posted gains of 11.5% and 18.1%. However, condos continue to drive market growth, as the majority of buyers remain priced out of BC’s detached market.

Ontario : The pace of price growth has dropped throughout the Greater Golden Horseshoe with the exception of Guelph, where home prices rose 3.8%. However, they fell 5.4% for Toronto real estate, 5.9% in Oakville-Milton, and 6.3% in Barrie and District. CREA points out that these declines seem steep only in comparison to last year’s record-breaking sales activity. “This reflects rapid price growth recorded one year ago and asks recent month-over-month price gains in these markets,” states its May report.

Ottawa, however, continues to buck the slowing trend, as millennial buyers flock to the city for its relatively affordable detached homes, driving overall prices up 8.2%.

Prairies : Prices are down in each large urban centre in central and western Canada, falling 0.5% and 0.9%, respectively, in Calgary and Edmonton. Regina and Saskatoon, however, saw more moderate declines, falling 6.2% and 2.7%.

Eastern Canada : Montreal continues to sizzle as the hottest up-and-coming market, with price growth of 6.7%, followed by 4.8% in Greater Moncton.

CREA Updates 2018 Forecast as May Sales Disappoint by Penelope Graham | zoocasa

Recent Comments