‘Twas the night before Christmas, when all through the house – not a creature was stirring, not even a mouse. Well, except for Evan Siddall… fine, it was the afternoon and he was on Twitter. On Christmas Eve, the CEO of the Canada Mortgage and Housing Corporation (CMHC) defended mortgage stress testing. The head of the agency warned first-time buyers that a stress test is unfair, but it’s better than risking your home.

The Who? From Where?

Evan Siddall is everyone’s favorite renter/former Goldman Sachs exec, that happens to be the CEO of the CMHC. For our new readers, the CMHC is the Crown Corporation that acts as Canada’s national housing agency. They play an important role in providing mortgage liquidity.

Who he is pretty important for context here. He’s not a short-seller your real estate agent convinced you might have another angle. He’s not someone that’s jealous of your 300 sqft condo with a combination bathroom/kitchen. This is the person who the government appointed to help you get a mortgage to buy a home, and help banks manage risk.

Stress Testing Real Estate Buyers

Unfamiliar with stress testing? Stress testing is when lenders make sure a borrower can pay their mortgage at higher rate. The majority of new mortgages in Canada require a stress test. This helps to ensure borrowers can continue to make payments if borrowing rates rise. Borrowers that pass a stress test, also show they have a little wiggle room for emergencies. An unspoken benefit is owners can top up equity in the event the home falls below a critical threshold. Negative equity for instance, would require a top up, and you’ll need extra cash to pay that Realtor.

Ensuring a borrower can continue to keep their home, even if their expenses rise? Those Canadians are monsters! At least that’s what some politicians and real estate developers have been saying. Afterall, before 2016 there was no test, and the market did, uh… just fine. Many believe that the rules should be put on hold, until the impact can be studied. It’s unclear if these people understand the irony of what they’re promoting. They want the impact to industry to be studied, before lenders are required to study the quality of their borrowers. Clearly the generosity of our selfless politicians and real estate developers knows no bounds.

Sucks To Be Stress Tested, But It’s Better Than Losing Your Home

In just under 400 characters, Siddall gave an important lesson on risk to buyers that might think it’s unfair.

Important advice, but probably not actually decipherable by a first-time home buyer (FTHB). Let’s do some napkin math, and run the scenarios laid out. Today’s calculations are on a $500,000 home at 5% down (the 95% LTV), with a 5 year fixed mortgage at 3.89% and 25 year amortization. That means the buyer put $25,000 down, and added $19,000 to the mortgage for insurance. At the end of 5 years, the buyer will have paid $64,782 towards principal, and $89,369 towards interest. We’re only going to be using the $154,150 in payments over 5 years. Costs like taxes, maintenance, and insurance will be excluded.

First scenario is prices go up 10% over those 5 years. In the event that does, you’ve made a $50,000 gain, bringing the value of your condo to $550,000. Combine the gain with the amounts you’ve contributed to principal, and you have $139,782 in equity. The power of leverage, amirite?

The second scenario is prices go down 10% over those 5 years. In the event this happens, the value of your home drops $50,000, bringing it’s value to $450,000. That’s the 200% loss of the down payment he’s referencing. Combine your down payment, amount contributed to principal, and you have $39,782 left. Life’s hard when you pay $179,150, to be left with less than $40,000. Turns out leverage works both ways.

Isn’t That Always True?

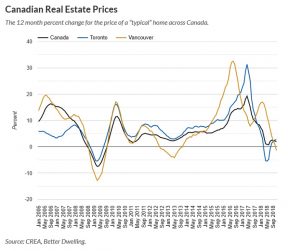

Yes, this could happen at any point. 5 years ago, you could have put money down in Toronto or Vancouver, and added a nice chunk of equity to your name. Or you could have put it into a home in Calgary and lost 7.73% plus carrying costs. There’s always a risk, but you try to balance that with probability.

Towards the end of the real estate cycle, gains tend to taper or turn negative. This is especially true after a large run in real estate prices, after gains may be exhausted. Siddall isn’t making a statement on whether we’re at the peak yet. However, he does appear to be saying you’ll be glad there was a stress test if we are.

Canada’s National Housing Agency CEO : Stress Tests Are Better Than Losing Your Home by Better Dwelling

Recent Comments