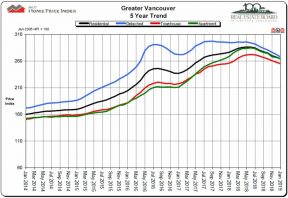

Metro Vancouver’s housing market is finally beginning to cool, in some ways. According to a Real Estate Board of Great Vancouver (REBGV) report released (February 4), the region is seeing some of the most significant declines it’s experienced in years.

“Residential home sales in the region totalled 1,103 in January 2019, a 39.3 percent decrease from the 1,818 sales recorded in January 2018,” it reads. “Last month’s sales were 36.3 percent below the 10 year January sales average and were the lowest January-sales total since 2009.”

But while sales are down, prices are not, or at least not down in any way that a middle-class couple hoping to enter the housing market might find meaningful.

“Home prices have edged down across all home types in the region over the last seven months,” REBGV president Phil Moore says quoted there. But edged down to what?

The benchmark price for an apartment on the city of Vancouver’s east side was $530,500 in January 2019, according to the report. That’s down 8.5 percent from six months earlier, but still up 87.1 percent from give years earlier.

The benchmark price for an apartment in New Westminster also still sits at more than half a million dollars. The same goes for North Vancouver, Burnaby, and Richmond.

Entry-level housing prices in Metro Vancouver have declined, but remain miles above where they were just a few years earlier.

In a telephone interview, Sydney Ball, a steering-committee member of the Vancouver Tenants Union (VTU), said the recent dip in prices hasn’t translated into good news for renters, or into any news at all.

“We have a less-than-one-percent vacancy rate, and so it is going to take something monumental before we see something change in Vancouver,” she told the Straight.

According to PadMapper, a website that collects data from public listings like those posted on Craigslist, the median price listing for a one-bedroom apartment inside the city of Vancouver sits at $2,130 as of January 2019.

“I’ve only been in my apartment for three years, but I know that it could fetch at least $400 or $500 [per month] more on the market,” Ball said. “That knowledge makes me feel insecure.”

Spencer Chandra Herbert, NDP MLA for Vancouver-West End, similarly shared a personal story when asked about recent changes in the market.

“In my neighbourhood, you have families raising their kids in one-bedroom [apartments], as my husband and I are, because housing is so unaffordable, even with really good wages,” he told the Straight.

Chandra Herbert’s government has intervened in B.C.’s housing market in a number of ways since it took power in a partnership with the Greens in July 2017. It increased the former Liberal government’s tax on foreign buyers from 15 percent to 20 percent, for example, and increased the property-transfer tax on homes valued at more than $3 million. Chandra Herbert gave those initiatives some credit for downward trends in B.C. housing markets, but emphasized there’s still a lot more work that needs to be done.

“We’ve got to get back into the affordable-housing game on the nonprofit side,” he said.

“And not just [low-income] social housing but nonprofit housing for middle-income people,” Chandra Herbert continued. “We need to do more on the co-op side, the nonprofit housing side. There are lots of people who I know who make good incomes, are not looking to profit from housing, and who just want a home where there is enough room to raise their kids.”

Tsur Somerville is an associate professor at UBC’s Sauder School of Business who focuses on real-estate markets. He was less inclined to give credit to the NDP for recent shifts in trends, emphasizing there are many large forces at work.

“We’ve been in a decline for a while, from a cycle standpoint,” Somerville told the Straight. “You’ve got the foreign-buyers tax, you’ve got things in China that have affected the flow of money, you’ve got our housing cycle in general and it having reached a peak and having a downturn, and you’ve got federal policies that have tightened mortgage eligibility.

“And once a market turns, particularly from a buyer’s standpoint, there is a change in attitudes,” he continued. “From, ‘Oh my god, I have to buy now or I’ll be priced out’, to, ‘Oh, I can wait’. And that behavioral change leads to self-reinforcing market dynamics.”

Somerville also noted that it’s normal for sales figures to change before prices do, and so the sales declines observed across Metro Vancouver in recent months could still translate into larger drops in prices.

“We haven’t had declines that have substantially changed the narrative around affordability, but we have things that are consistent with progress there,” he said.

On market interventions, Somerville said he would like to see the government more involved on the supply side.

“Creating options who for people who may be middle class but who can’t afford ownership and are still looking for some form of stable tenure,” he said. “And I think there is a lot more than can be done on helping people who are challenged in the rental sector.”

Chandra Herbert told the Straight that B.C. minister of finance Carole James continues to monitor housing prices and related indicators such as employment and wages. He emphasized the NDP could take further action on housing.

“Clearly, there is a lot more to do,” he said.

Greater Vancouver Housing Markets Dip But So Far Bring Little in The Way of Affordability by Travis Lupick | The Georgia Straight

Recent Comments