The prolonged effects of tougher mortgage policies continued to make their mark on national home sales and prices in February, with the Canadian Real Estate Association’s latest report revealing the largest monthly decline in activity since the stress test was introduced last January.

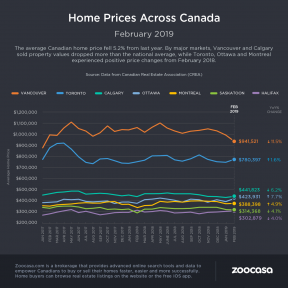

Sales fell “sharply” by 9.1% from January, and are down 4.4% from the same month in 2018. That’s had a downward pull on prices, with the national average falling 5.2% year over year to $468,350, and coming in at $371,000 without Toronto and Vancouver factored in. The MLS Home Price Index, which measures the value of homes trading hands, also fell for the first time in a decade, though by a minimal amount at 0.1%.

It was the lowest level in 10 years for February sales, as CREA reports that they’re down in three quarters of all markets, including Canada’s largest cities. The decline is most acute in the British Columbia, Alberta, and Newfoundland and Labrador markets, where activity is actually 20% below the 10-year average, compared to 12% throughout the rest of the nation.

Stress Test Impact Continues to Be Felt Across Nation

CREA continues to point to the mortgage stress test as a major contributor to the market slowdown, and has hit back at recent commentary from the lending industry defending the measure as being appropriate.

Said CREA President Barn Sukkau in the association’s release, “For aspiring home buyers being kept on the sidelines by the mortgage stress test, it’s a bitter pill to swallow when policy makers say the policy is working as intended. Fewer qualified buyers means sellers are affected too.”

Gregory Klump, CREA’s Chief Economist, said that slower housing market activity is expected to have an overall downward pull of the economy, and urged policy makers to reconsider the extent of the measures taken.

“February home sales declined across a broad swath of large and smaller Canadian cities,” he said. “The housing sector is on track to further reduce waning Canadian economic growth. Only time will tell whether successive changes to mortgage regulations went too far, since the impact of policy decisions becomes apparent only well after the fact. Hopefully policy makers are thinking about how to find tune regulations to better keep housing affordability within reach while keeping lending risks in check.”

Slowdown in Sales Offsets New Supply

The number of newly-listed homes in February also fell 3.2%, with the greatest contractions in supply seen in the Greater Toronto Area, Hamilton-Burlington, as well as the western markets such as Calgary, Edmonton, and Winnipeg.

However, that wasn’t enough to offset slower sales activity, which softened overall buyer conditions. The national sales-to-new-listings ratio, which measures the level of competition in the market, fell to 54.1% from 57.6% in January. While that’s still within balanced territory, it’s a step back from levels that were approaching a sellers’ market just one month ago. CREA considers a ratio between 40 – 60% to be balanced, with below and above that threshold to be buyers’ and sellers’ markets, respectively.

According to this criteria, 70% of all markets remained balanced, while the level of inventory – the number of months it would take to fully sell all homes available on the market – remained at a three-and-a-half-year high at 5.7 months. However, this was unevenly distributed across the country, with inventory much higher than is typical in the Prairie provinces and Newfoundland and Labrador, and below usual levels in Ontario and the Maritimes.

Price Growth By Home Type

Condos continue to lead the market in terms of price growth, with the average unit up 2.4%. Townhouses also experienced a 1% increase, while one- and two-storey house prices fell -1.7% and -1%, respectively.

Home Prices by Region

British Columbia :The province has been ensnared in a sustained slowdown since the start of 2019, with local real estate associations reporting a 30% drop in sales in February. That’s had a negative impact on prices, which fell -6.1% in Greater Vancouver, and -2.8% in the Fraser Valley. However, prices rose 3% in Victoria, and were up 7.7% elsewhere on Vancouver Island.

Ontario : Despite slower sales, the Greater Golden Horseshoe markets continue to experience price growth. Values were up 2.3% in the GTA, 6.8% in Guelph real estate, 6.5% in Niagara, 5% in Hamilton-Burlington, and 0.2% in Oakville-Milton. The Barrie and District markets were the only ones to see prices decline by -4.3%. The MLS Ottawa market, however, continues to boom with prices up 7.4%.

Prairies : CREA points out that supply is “historically elevated relative to sales” across the Prairie provinces, which continues to put downward pressure on prices. They fell by -4.4% in Calgary, -4.5% in Edmonton, -5.1% in Regina, and -3% in Saskatoon. “The home pricing environment will likely remain weak in these cities until demand and supply come back into better balance,” states CREA’s release.

Eastern Canada : Montreal continues to be one of the strongest markets in the nation, experiencing strong price growth of 6.2%. Greater Moncton also saw an increase of 1.6%.

CREA Revises Forecast for 2019 – 2020

The national association has tweaked its forecast for sales and prices for this year and next, prompted by the sustained impact of mortgage policies.

“While the outlook for economic growth has dimmed since CREA’s previous forecast was released last December, interest rates together with labour market and demographic fundamentals remain supportive for housing demand. However, policy headwinds continue to limit access to mortgage financing and dampen market sentiment,” states the release.

It is forecasted that national sales in 2019 will be the weakest in a decade and the lowest per capita in 20 years, down -1.6% to a total of 450,400 units. Most of the pain will be in BC as well as in Alberta, although gains in Quebec and Ontario will partly offset slower activity.

The average price is expected to stabilize at $487,000 next year, down -0.2%, though prices are expected to fall further in Alberta, BC, Saskatchewan, and Newfoundland and Labrador. However, they’ll continue to rise in Eastern Ontario, Quebec, New Brunswick, Nova Scotia, and PEI, as well as in the GGH.

National sales will tick higher in 2020 by 2% to a total of 459,400 units, with average price trends to be moderate versions of what’s experienced in 2019.

CREA Report : National Home Sales and Prices Fall in February by Penelope Graham | zoocasa

Recent Comments