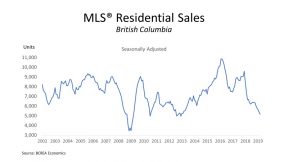

The impact of the mortgage stress test continues to be shown in home sales in British Columbia.

British Columbia Real Estate Association says there were 5,707 sales through the MLS in March, down 23% year-over-year, while the average price was down 5.4% to $687,720.

“BC home sales continue to be adversely impacted by federal mortgage policy,” said BCREA Chief Economist Cameron Muir. “The erosion of affordability caused by the B20 stress test has created near recession level housing demand despite the province boasting the lowest unemployment rates in a decade.”

Total sales dollar volume was $3.9 billion, a 27.1% decline from the same month last year.

Listings increased 36.2% to 34,295 units from a year earlier and the ratio of sales to active residential listings declined from 29.4% to 16.6%.

“The sharp erosion of affordability caused by the B20 stress test is now creating pent-up demand, as many would-be home buyers are forced to wait on the sidelines,” added Muir. “Unfortunately, new home construction is slowing as well, which will likely lead to another housing supply crunch down the road.”

Mortgage Stress Test Has Caused “Near Recession” Housing Demand by Steve Randall | Canadian Real Estate Wealth

Recent Comments