The first numbers for the 2020 Canadian housing market are in and they point to steadily heating real estate conditions this year, with more double digit-increases in sales and prices recorded in January compared to 2019.

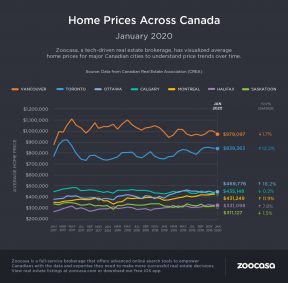

According to the latest report from the Canadian Real Estate Association, the number of home transactions rose 11.5% year over year, while the average home price increased 11.2% to $504,350. More telling, the MLS Home Price Index, which measures the overall value of homes sold, was up 4.7% y-o-y, its eighth-monthly gain and up 5.5% from the May 2018 low. Overall home values were up in 14 of the 18 markets that CREA tracks.

Too Few New Listings Put the Squeeze on Home Buyers

However, the defining feature of today’s housing market is a lack of new supply. That’s putting the squeeze on home buyers, and has even trickled down into short-term sales; with too few options to satiate demand in some markets, month-over-month sales actually dipped by -2.9%, despite the year-over-year picture reflecting the best January sales figures seen in 12 years. Overall, new listings remain at a decade-low.

That’s shifted the current market power dynamic strongly to sellers, says CREA Chief Economist Shaun Cathcart, who suggests many are likely waiting for nicer weather to put their home on their market, contributing to a crunch in the short term.

“Looking at local market trends across the country, one thing that stands out in markets with historically tight supply is a larger than normal drop in new listings at this time of year. The logic being that if you are a seller, you’re not just choosing when to list, but effectively when to sell, so why not hold off until the spring when the weather is better and more buyers are looking?” he says. “Deferred listings mean deferred sales which could explain some of January’s decline in activity. The question going forward us how many sellers are out there waiting to list their property, how much demand will respond, and how that will impact prices later this year.”

Prairie Markets Continue to Struggle

However, as has been the long-developing trend, supply issues aren’t equal across the nation – several markets, particularly in the Prairies and parts of eastern Canada, can actually still be considered buyers’ markets.

Said CREA President Jason Stephen, “Home price growth continues to pick up in housing markets where listings are in short supply, particularly in southern, central, and eastern Ontario. Meanwhile, ample supply across the Prairies and in Newfoundland and Labrador is resulting in ongoing competition among sellers.”

Canada Remains in Sellers’ Market

However, the very slight increase in listings noted last month has marginally lowered the national sales-to-new-listings ratio (SNLR) to 65.1% from the 67.2% in December. This ratio, which is calculated by dividing the number of sales by the number of new listings brought to market over the course of the month, is an indicator of the level of buyer competition. A ratio percentage between 40 – 60% points to a balanced market, while above and below that threshold reveal sellers’ and buyers’ market conditions, respectively.

For perspective, the long-term average for the national SNLR is 53.8% – the market has outperformed this over the last four months, indicating sellers’ markets are sticking around, and will put upward pressure on home prices should they continue to do so.

As well, the total months of inventory – the amount of time it would take to sell off all of the available MLS listings in Canada – is 4.2, where it has remained for the previous three months. That’s a full month below the long-term average of 5.2 months. However, like new listings, shortages in available supply range across Canada, with some markets, including the Prairies and Newfoundland and Labrador, continuing to experience a glut.

Ontario, BC Home Prices Set to Sizzle

Due to the tight sellers’ markets found in most of Canada’s cities, home prices are on the rise, especially in Ontario’s Greater Golden Horseshoe such as homes for sale in Toronto and in parts of British Columbia. Vancouver real estate, in particular, is seeing values bounce back after several years of declines. While y-o-y prices are still -1.2% where they were in 2019 in Greater Vancouver, the pace of declines is slowing. Prices are up, however, by 0.3% in the Fraser Valley, 3.5% in the Okanagan Valley, 3.4% in Victoria, and 4% on the rest of Vancouver Island.

In contrast, the Prairie markets of Calgary, Edmonton, and Saskatoon have posted small y-o-y declines while prices plunged -6.9% in Regina. In Ontario, double-digit price growth continues to be the norm, especially across the GGH. Ottawa, Montreal, and Moncton are also booming, with prices up 13.7%, 9.8%, and 6.4%, respectively.

By home type, apartments are leading the market in terms of price growth, up 5%, with two-storey single-family homes up 4.8%. That’s followed by one-store single-family at 4.4%, and townhouses up by 4.2%.

Check out the infographic below to see how home prices performed in Canada’s largest markets in January :

CREA : January Canadian Home Sales Down Due to Supply Crunch by Penelope Graham | zoocasa

Recent Comments