Another survey by a Canadian bank finds that some Canadian homeowners are not very secure, financially speaking. About one-quarter said that they had just $1,000 set aside for an emergency, while another quarter didn’t even know how much they had. The lowest amount of emergency funds was reported by Millennial homeowners (20–34 years old). Almost four in ten homeowners with mortgages said they had some difficulty affording their mortgage and other home-related expenses. About one-third said they would have difficulty paying the mortgage within three months if the main breadwinner lost his or her job.

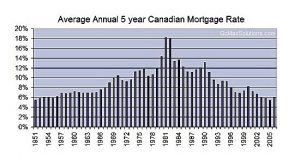

What most surprised Rick Lunny, president and CEO of Manulife Bank of Canada, was what Millennials said about mortgage rates. More than one-third thought mortgage rates were too high, an assertion that “blew me off my feet,” said Lunny. This group is seemingly unaware that interest rates are at “multi-generational” lows, and have no idea what could happen if rates actually did go up. They obviously do not know that in September, 1981, the posted five-year mortgage rate in Canada was 21.75%. Today it is 4.64%.

To be fair, these Millennial homeowners may be reacting more to their own monthly costs rather than to the actual interest rate. Somewhat paradoxically, Millennials are more laid back about debt in general. More of them feel that carrying a credit card balance is not a “big deal.”

If interest rates do go up, and it’s only a matter of time until they do, Manulife Bank provides an example of how a rate increase could impact a mortgagor. With a mortgage of $174,000, which is the average mortgage reported by respondents to this survey, an interest rate of 2.89%, and an amortization period of twenty years, the monthly payment would be $954. That payment would increase by 10%, to $1,049 per month, if the interest rate rose by just over 1%. As it is, about three in ten homeowners spend more than 30% of their net income on mortgage payments.

Older Canadians do not escape criticism. A lot of baby boomers, it turns out, have not done a very good job of saving for their retirement. In fact, while most of them (79%) say they want to stay in their current home in retirement, many (22%) admit that the home will represent more than 80% of their wealth when they retire. How will they afford to live in their home?

If that home were worth, say, $1 million, that would mean the homeowner’s wealth was $1.25 million, plus whatever income was coming in from pensions and investments. Baby Boomers are also less likely to have a mortgage; 57% have no mortgage debt. But if that is still not enough to live on, Manulife Bank suggests that they access their equity through a home equity line of credit.

Generation X, those born between the Baby Boomers and the Millennials, are also concerned about being able to save for retirement, the survey found. Only one in three Gen Xers expressed confidence about being able to maintain their lifestyle in retirement, compared to 41% of Millennials and 45% of Baby Boomers. In fact, this was the top source of stress for this demographic, followed by not having enough time to do everything they want to do. (Perhaps if they didn’t do so much, they wouldn’t spend as much.)

Mortgage Rates Too High? Only If You’re a Millennial by Josephine Nolan | Condo.ca

Recent Comments