You’d have to go back to the year 1990 to find the last time Canadian homes were so unaffordable for the typical buyer, leading one of the country’s biggest banks to question whether ownership is only for the wealthy now.

According to RBC, which just released its third-quarter analysis of the cost of home ownership, households in Canada need to fork over 53.9 percent of their incomes to afford the average-priced home.

The “main culprit” as RBC sees it is rising interest rates. Mortgage rates have risen for five consecutive quarters as the Bank of Canada has embarked on monetary tightening. The central bank has hiked its overnight rate, which influences the mortgage marketplace, five times since July 2017.

Homebuyers are most stretched in Vancouver, where it takes an 86.9-percent share of a household’s income for a typical home. Toronto follows as households need to shell out 75.3 percent of their incomes to saddle the cost of ownership.

To rank affordability, RBC looks at what share of a median pre-tax household income would be needed to afford an average-priced home. Calculations assume a 25-percent downpayment and a 25-year mortgage with a five-year fixed rate.

High housing costs in Canada led RBC to ask “are only the rich able to buy a home these days?” The answer, according to the bank: “That certainly looks like it in Canada’s most expensive markets.”

Specifically, RBC highlighted Vancouver, Victoria and Toronto — where buyers need two to three times the median income to even qualify for a mortgage and carry the cost of ownership — for their respective affordability issues.

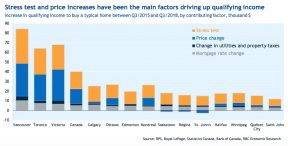

On top of rising rates, the federal government’s stress testing on uninsured mortgages has further intensified challenges for buyers. In fact, for Vancouverites, the stress test means the minimum qualifying income shot up $36,000. Minimum qualifying incomes in Victoria and Toronto surged $25,000 and $27,000, respectively.

That means that in Vancouver, a household would need to pull in at least $211,000 annually. Meantime in nearby Victoria, the minimum income as $154,000, while for Toronto it was $167,000.

“Thousands of dollars more in income are now needed to buy a home with a mortgage in every market across the country because of the stress test,” says RBC.

RBC doesn’t expect the situation for house hunters will improve meaningfully next year as economists predict two more Bank of Canada rate hikes in 2019. However, RBC isn’t expecting a significant worsening in affordability either. “A generally soft environment for prices and rising household income will contain some of that pressure,” the bank notes.

Of Canada’s major markets, Edmonton was the most attainable market for homeowner hopefuls. There, an average home requires 28.2 percent of the median income for a local household. The next most affordable market was Ottawa, where 38.6 percent of the median household income was needed. Calgary and Montreal followed at roughly 45 percent each.

But the tide seems to be shifting in Montreal. In fact, Montreal’s affordability measure worsened the most of any market RBC tracked last quarter. The share of household income needed to afford a home in Montreal increased by a whole percentage point from the previous quarter.

“The area has been one of the stronger markets in Canada in the past year—another being Ottawa—that saw solid price gains amplify the effect of higher interest rates on ownership costs,” says RBC. “Despite some deterioration in the latest period, owning a home remains affordable in the majority of other markets in Canada.”

Canadian Homes Haven’t Been So Unaffordable Since 1990 & A Big Bank Asks is Ownership Only for The Rich? by Josh Sherman | Livabl

Recent Comments