Now that the new home down payment requirements are in place, the big unknown is how much impact they will have on home buyers, especially first-timers. Most observers agree that the graduated increase, which raises the down payment on a home costing between $500,000 and $999,999 from 5% to an effective maximum rate of 7.5%, will have little impact outside of Toronto and Vancouver. Those most likely to be affected are first-time buyers in those two markets. The average price of a home in Toronto as of January, 2016, was $636,728, an increase of 9.2% over the previous year, according to Toronto Real Estate Board statistics.

But how widespread will the effects be? Not so much, most industry experts agree. Because the new down payment required is calculated only on the portion of the price that is above $500,000, many buyers will not be affected at all. According to the trade publication Canadian Mortgage Trends, fewer than one in ten first-time buyers purchase above $500,000. Of those who do, CMT “guesstimates” that “somewhere around half” already have at least 7.5% for a down payment.

As 7.5% is the maximum needed under the new rules (for a home costing up to $999,999), fewer than 0.5% of buyers would be affected, and they would need to come up with only 0.1% to 2.5% in additional down payment funds. The Minister of Finance put the expected number of affected purchasers at 1%. That relatively small group who come up short will either have to borrow from the parents or some other source, look for a less expensive home, or wait a little longer to buy.

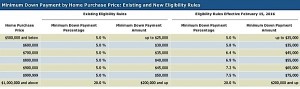

How the change affects the down payment

On a home costing $600,000, the down payment will now be calculated at 5% of the first $500,000, for $25,000, and 10% of the remaining $100,000, for $10,000, giving a total of $35,000, a rate of 5.8% of the total purchase price. Previously, the down payment needed would have been $30,000. As shown in the table below, the maximum down payment required for homes costing up to $999,999 is 7.5%. Homes costing more than $1 million continue to require a down payment of 20% to qualify for CMHC mortgage insurance coverage.

The federal government’s approach to the down payment rise has been praised by industry leaders for being less disruptive than other options it had, including imposing a flat 10% rate, or lowering debt ratio limits. Phil Soper, president and CEO of Royal LePage noted that the down payment changes are a more finely tuned approach than using monetary policy, which would affect everyone. This change, he said, recognizes that some parts of the country need a “mild tap on the break” while other areas need stimulus.

Will New Down Payment Requirements Slow Housing Market? by Josephine Nolan | Condo.ca

Recent Comments