Don’t bet on Toronto or Vancouver home prices continuing to rise indefinitely at the same pace as they have done. That’s the message from the Bank of Canada’s governor Stephen Poloz. In his more bankerly words, prospective home buyers and their lenders “should not extrapolate recent real estate price performance into the future when contemplating a transaction.” He made the comment in connection with the release of the bank’s bi-annual Financial System Review.

The “caveat” about home prices from the central bank’s governing council, said Poloz, is merited because, though the stability of the financial system is essentially unchanged since the last report, and is in fact expected to strengthen as the economy recovers, home price growth is “unlikely” to be sustained given the underlying fundamentals. In other words, there is the potential for a price downturn, though the extent of such a downturn is “difficult to quantify.” A “significant” downturn could have serious consequences for some individuals and some mortgage lenders, but that would likely only happen if the country experienced a severe recession. The risk that this will happen remains quite low.

The bank’s report focuses on the same three economic vulnerabilities and their associated risks as in past reports. Two of these vulnerabilities pertain directly to housing: household indebtedness and imbalances in the housing market. According to Poloz, these have moved higher in the past six months; however, the probability of the risks that stem from them being triggered is now lower. This is because of the improving economic outlook.

In general, the risk factors that could precipitate a downturn in the housing market include a large increase in unemployment caused by a severe recession, a sharp jump in interest rates, a sudden rise in “stress” from China or other emerging economy, and a prolonged period of low commodity prices. All things considered, said Poloz, financial stability risks overall have not changed materially since the last report.

The first two vulnerabilities, household indebtedness and imbalances in the housing market, have both moved higher since our last report. However, in view of the improving economic outlook, there is now a lower probability that the risks stemming from these vulnerabilities will be triggered. This combination of higher vulnerabilities but lower probability leaves the financial stability risks related to those vulnerabilities roughly unchanged from our last report. Our view is still that a strengthening economy and rising incomes will reduce these vulnerabilities over time for the country as a whole.

The Financial System Review does not make recommendations about the housing market, but the government has indicated that it is looking closely at the country’s real estate markets to see if there are additional measures it can take to ensure that Canadians can afford to buy homes.

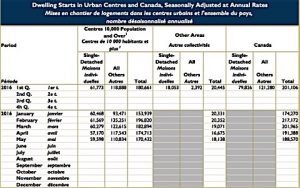

One thing that is not likely to change soon is the wide regional divergence in the housing market. This is reflected somewhat in Canada Mortgage and Housing Corporation’s latest housing start numbers, and Statistics Canada’s building permit numbers. May housing starts were down in British Columbia and the Prairies, but up everywhere east of Manitoba. Toronto saw fewer homes started (33,103 compared to 37,359 in April) mainly because of fewer condominiums. Outside the GTA, however, starts were generally higher, so that province-wide the number was up compared to April (64,918 versus 62,403).

The value of building permits issued in April across Canada was down 6.2%, due to fewer condominium buildings. Single-family dwelling permits were up 1.8%. Ontario had the largest drop, 9.2%. The value of permits for condos in Ontario was down 20.1%, though this followed a huge increase of 31.6% in March.

Home Prices Can’t Go Up Forever, but Bank of Canada Says Financial System is Sound by Josephine Nolan | Condo.ca

Recent Comments