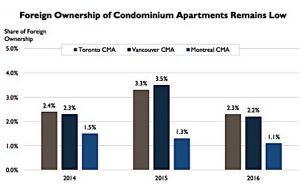

Canada Mortgage and Housing Corporation says that the question of foreign ownership in Canada’s housing markets is an important one, but the number of foreign owners is quite low. Most of them are concentrated in Toronto, Vancouver and Montreal, but the highest percentage in 2016 was just 2.3%, in Toronto. This was lower than in the previous year. This is the third year that CMHC has gathered information about foreign ownership through its Condominium Apartment Survey. The information comes from property managers and is also used to determine the condominium vacancy rate in the rental market. It does not include information about foreign buyers of freehold homes.

The survey shows that foreign owners, defined as persons whose primary residence is outside Canada (and therefore includes Canadian nationals living abroad), prefer newer, larger, more centrally located condominium buildings. In Toronto, foreign owners bought 3.9% of units in condos built since 2010, almost double the share for the entire stock. They bought 5.5% of units in condominium buildings with more than 500 units. Similar results were seen in Vancouver.

The national housing corporation also released its third quarter financial results for the period ending September 30, 2016. During the quarter it earned $331 million in net income, and provided mortgage loan insurance for 26.8% more Canadian homebuyers than in the same period a year ago. Nevertheless, its total insurance-in-force dropped by $9 billion from the previous quarter and now stands at $514 billion. The legislated limit for CMHC is $600 billion, and it has been steadily reducing the total for several years now.

Helping Canadians access housing that meets their needs is what CMHC is about and our third quarter results reflect the continued strength of our business. Despite economic challenges in parts of the country, we continue to generate a positive return for all Canadians. What’s more, our portfolio remains strong as evidenced by the increasing equity borrowers have in their homes and the downward trend of our arrears rate, among other factors.

The report gives a positive picture of the average CMHC-insured homeowner. Average equity in their homes increased in the third quarter from 34.4% to 34.8%. Homebuyers also have a “strong” ability to manage their debts; the average credit score for homebuyers was 751, while the average gross debt service (GDS) ratio was 25.7%. A GDS of 30% is the upper limit allowed by CMHC.

Another indicator of the strength of the residential mortgage portfolio is the low rate of arrears. The rate was unchanged from the previous quarter, standing at 0.32%, in line with historical norms. Just 8,286 mortgagors were in arrears in the third quarter. Insurance claims did increase substantially (152.8%) in the quarter, however, due to “higher than expected” claims by homeowners with high ratio mortgages in oil-producing regions.

CMHC : Foreign Ownership Low in Canada’s Condo Markets by Josephine Nolan | Condo.ca

Recent Comments