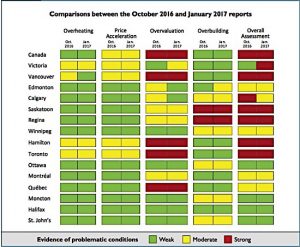

In Canada’s current housing market, Ontario is the pivot. East of Ontario, there is little evidence of strongly “problematic” conditions or imbalances, such as overheating and overbuilding, in any major markets. West of Ontario, there is plenty, with “strong” evidence of such problematic conditions found in cities from Regina to Vancouver and Victoria. When assessing price growth in the national housing market, which Canada Mortgage and Housing Corporation calls “elevated,” CMHC says that without Ontario included, price growth for the third quarter of 2016 was actually flat. With Ontario included, that growth was 7%, thanks to intensified price growth in Toronto and other cities, including Hamilton (10%), Oshawa (21%), Barrie (16%) and Kitchener (13%).

Toronto and Hamilton are now mirror images of one another in terms of problematic conditions, showing an identical profile. Both markets are now moderately overheated, moderately accelerated in pricing, strongly overvalued, and weakly overbuilt, according to CMHC’s latest market assessment, just released in the first quarter of 2017. They share an overall assessment of red for danger, i.e., strongly problematic conditions.

Hamilton can thank its close proximity to Toronto for that dubious honour. Price growth in the city, where conditions of weak employment and slow income growth prevail, has exceeded levels “consistent with fundamental drivers,” the result of would-be homebuyers from Toronto looking to Hamilton for something more affordable. The sales-to-new-listings ratio in Hamilton was just above the threshold for overheating, in which demand greatly outpaces supply, CMHC said.

Toronto, meanwhile, has had three consecutive quarters of moderate overheating and sustained evidence of price acceleration throughout 2016. This was seen among all housing types, but especially in the higher-end single-detached sector. Declining inventories of both new and resale single-detached homes led to rapid price growth, a growth that has not been matched by growth in personal disposable income, the corporation said.

The number of condo units under construction in Toronto moved “slightly” lower in the third quarter of 2016, though numbers are still above long-term averages. Builders, CMHC advises, should monitor inventories closely to ensure that they remain low in the event that demand were to moderate.

A report on the health of Canada’s housing markets just released by RBC notes that price acceleration in Toronto and the resulting decline in affordability is the main source of concern, increasing the likelihood of “policy intervention” to address housing risks. The RBC report mainly characterizes the Toronto market as “within historical norms” for markers such as resale market balance, interest rates, labour market, demographics, new home inventory, and new homes under construction (singles). Only affordability and the construction of multi-residential buildings are described as “significantly outside historical norms.”

RBC believes that the probability of a “steep and widespread” downturn in Canada’s housing market in the next twelve months remains low.

CMHC : Strong Evidence of Overvaluation, Overpricing in Canada’s Housing Markets by Josephine Nolan | Condo.ca

Recent Comments