Prices in Canada’s most expensive city for existing homes appear to have rebounded from the impact of a tax on foreign buyers as Vancouver realtors reported Tuesday a huge swing in demand for condominiums and townhomes in April.

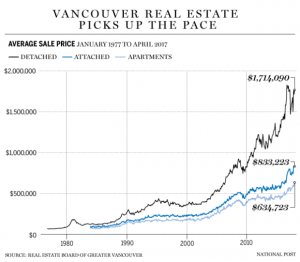

The Real Estate Board of Greater Vancouver said the composite benchmark price for all residential properties in Metro Vancouver was $941,100 in April, an 11.4% increase from a year ago but a five per cent jump in the past three months.

Sales of all property types dropped 25.7% from a year ago to 3,533 in April but were 4.8% above the 10-year average for the month. Compared to March sales, April activity fell 0.7%.

“Our overall market is operating below the record-setting pace from a year ago and is in line with historical spring levels. It’s a different story in our condominium and townhome markets,” said Jill Oudil, president of the board. “Demand has been increasing for months and supply is not keeping pace. This dynamic is causing prices to increase and making multiple offer scenarios the norm.”

The board said for the first four months of the year, condominiums and townhomes accounted for 68.5% of all residential sales, up from the 58.2% average over the same period last year.

“Until more entry level, or missing middle, homes are available for sale in our market, we’ll likely continue to see prices increase,” Oudil said. “There’s been record building this past year, but much of that inventory isn’t ready to hit the market.”

The Vancouver market has seen sales decline steadily since the province announced an additional 15% tax on foreign buyers effective Aug. 2, 2016. Ontario followed with its own 15% on foreign buyers, calling it a non-resident tax and extending it to the entire Greater Golden Horseshoe which affects a population of about nine million people in southern Ontario.

Doug Porter, the chief economist with Bank of Montreal, said the evidence is clear that the tax in British Columbia did cool Vancouver’s single detached home market. “Vancouver was as hot as a fire cracker in 2016,” said Porter. “It looks the shock of the tax is wearing off. But who knows where prices would have been absent the tax?”

April new listings for detached, attached and apartment properties in Metro Vancouver totalled 4,907, a 19.9% decrease from a year ago but a three per cent increase from March.

The total number of residential properties currently listed for sale in the region were 7,813 in April, a 3.5% increase from a year ago and three per cent bump from a year ago.

“It’s worth pointing out that according to the realtors each (segment) of the market is a seller’s market still,” said Porter, referring to detached, condominium and townhomes.

The sales-to-active listings ratio for April 2017 was 45.5% for all property types, two per cent below March 2017.

“Generally, analysts say that downward pressure on home prices occurs when the ratio dips below the 12% mark for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months,” said the REBGV.

By property type, the sales-to-active listings ratio was 26% for detached homes, 58.2% for townhomes, and 82.2% for condominiums.

Sales of detached properties dropped 38.8% from a year ago to 1,979 last month. The benchmark price for detached properties was $1,516,500, an 8.1% increase from a year ago and a 1.8% from March 2017.

Sales of apartment, or condominium, properties dropped 18.3% from a year ago to 1,722 while the benchmark price of $554,100 was up 16.6% from a year ago and 3.1% from March.

Attached, or townhome, property sales fell 10.8% in April from a year ago while the benchmark price was $701,800, a 15.3% increase from a year ago and a 2.4% from March.

Toronto numbers are due Wednesday, the first reporting period since it brought in its tax, but Porter doesn’t think Canada’s largest city will have the same reaction.

“I would suggest the tax was a shock in BC. I don’t think it was shock in Ontario, there was plenty of warning and hints (it was coming),” said Porter.

Vancouver Housing Market is Rebounding from Tax Impact, With Prices Up 5% in 3 Months by Garry Marr | Financial Post

Recent Comments