Should you choose a fixed or variable mortgage? That is one major question currently facing potential home buyers. Admittedly, it’s always an important consideration when purchasing a home, but more so today than in previous years.

And that’s because we’re currently in a rising rate environment.

The Bank of Canada has increased its target for the overnight rate three times over the past eight months, and mortgage rates have followed suit. The best available five-year variable rate in Toronto has increased to 2.15% from a January low of 1.95%.

Five-year fixed rates, meanwhile, are also on the rise; increasing from January’s mark of 2.79% to the current best rate if 2.99%.

And rates are expected to continue to increase, with the Bank of Canada teasing further hikes to its benchmark rate.

The most popular mortgage option among home buyers in Canada is the five-year fixed rate; 72% of purchasers during 2016 and 2017 went that route, according to Mortgage Professionals Canada’s latest Annual State of the Residential Mortgage Market in Canada study, published in Nov. 2017.

And that number will likely jump, as an increasing number of home buyers typically opt for fixed rates in rising rate environments.

But should they?

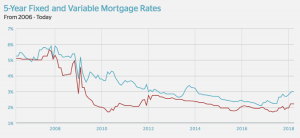

Let’s take a look at the historical performance of fixed and variable mortgage rates to get a better sense of which has traditionally cost less. Of course, the future cannot entirely be predicted by past events. But past trends can certainly help inform future decisions.

Where Were Mortgage Rates Pre-Recession?

Prior to the great recession in 2008, rates were high; much higher than they are today.

On May 1, 2006, the best five-year fixed rate was 5.25%; the best five-year variable rate, meanwhile, was 5.10%.

Not a major difference. It’s easy to look at what would happen next with a revisionist lens and argue the obvious choice would have been variable at the time. However, no one knew what was about to occur – that the United States’ housing market and economy, in general – would impact Canada’s own and lead to a major dip in mortgage rates.

This pre-recession period was the only time in recent history that fixed rates were cheaper than variable rates, and that window was brief.

In January 2007, the best five-year fixed rate available was 4.9%. The best five-year variable rate was 5.05%.

For the next decade, however, variable rates would go on to out-perform fixed rates.

But by how much?

Rates Begin to Diverge

Leading up to 2008, variable and fixed rates followed the same trajectory, more or less. However, just before 2010 variable rates fell to record-low levels (falling as low as 1.7% in April 2010) while fixed rates remained fairly pricey (4.24% that same month).

For a while, variable rates were the clear winner.

The Gap Closes

Beginning in 2012 fixed rates would enjoy a precipitous decline in prices. Variable rates did as well, though the difference in price was narrower than in years prior.

In January 2012, fixed rates fell to 2.99% – a seemingly impossible rate at the time. At that time, variable rates dipped as low as 2.75%.

Both fixed and variable rates would go on to trend downward until earlier this year. As mentioned, both are now on the rise.

The Future of Mortgage Rates

Ultimately, the choice comes down to risk tolerance. Are you willing to give up the security of fixed rates to potentially save money in the long-run? Then a variable rate could be your best choice. If you prioritize the assurance that your payments will remain fixed throughout your mortgage term, a fixed rate is the likely the preferred route.

However, if history is any indication, variable rates tend to outperform fixed rates. That’s certainly something to keep in mind; though speaking to a mortgage broker about which option suits your personal financial needs is a great place to start.

Should Buyers Go Fixed or Variable as Mortgage Rates Rise? by Justin da Rosa | zoocasa

Recent Comments