In 2024, spring and summer real estate activity was muted as buyers waited on the sidelines for affordability to improve. Then the fall came, and so did some major interest rate cuts from the Bank of Canada. This led to strong sales numbers across Canada and renewed optimism for the 2025 year ahead.

Now we are deep into 2025, and the BoC has cut interest rates for the third time this year. Could this fall mark a rebound in the real estate market? Or will continued economic uncertainty deter buyers? Our experts weigh in on how housing supply, mortgage rates, tariffs, and buyer sentiment are expected to shape the next few months in the Canadian real estate market.

Fall Activity Picking Up for The Right Properties at The Right Price

While some prospective buyers will stay cautious this fall, others will see opportunity in softening prices and increased supply.

“The burst of energy we saw in July and early August has started to taper off, but with mortgage rates holding or declining, more buyers may finally be ready to step off the sidelines for the right property this fall,” says Carrie Lysenko, Zoocasa CEO. “Detached homes in particular continue to draw interest in markets where affordability has improved.”

In both Toronto and Montreal, detached home sales in August 2025 outpaced the levels seen in August 2023 and August 2024, a strong signal that momentum in these markets will carry into the months ahead. Vancouver also saw sales gains in August, with detached homes up 13% from 2024.

At the same time, average prices continue to fall, giving sideline buyers an incentive to act now. The average detached home in Toronto decreased by 7.5% from last year, now at $1,312,240, while in Vancouver, the benchmark price sits at $1,950,300, representing a 4.8% decline from 2024.

Condo sales, on the other hand, are down significantly in Toronto, Vancouver, and Calgary. Across all three cities, August 2025 brought the lowest condo sales for that month in two years. And although Montreal’s condo sales for August 2025 were higher than in previous years, demand has been continuously trending downward since March.

So far, the retreat from the condo market has been intense. But as condo prices continue to slide, some buyers may finally be motivated to make a move. A joint CIBC, Urbanation report showed that resale condo sales in the GTA for units under $500K increased by nearly 50% in the first half of 2025 compared to 2024. For the right price and with the right conditions, condo buyers might re-engage.

Economic Uncertainty Continues into Fall, Keeping Some Buyers and Sellers on Hold

“We haven’t yet seen the full impact of tariffs, rate cuts, or delayed job market shifts, and that uncertainty is keeping some buyers and sellers in a holding pattern,” explains Lysenko. “We’re in a transitional period, where confidence plays a big role in who chooses to act and when.”

What makes both buyers and sellers confident? Economic stability. While mortgage rates are moving in the right direction, many Canadians may prefer to wait and see before making any big changes.

The Bank of Canada’s latest rate cut was welcome news for variable-rate mortgage holders, but those opting for fixed-rate mortgages haven’t seen much change in affordability. And with economic conditions changing rapidly, not every buyer wants to take on the risk that comes with a variable-rate mortgage.

According to Ratehub.ca, the average 5-year fixed rate hasn’t dropped lower than 3.74% in three years. Compared to the lows seen during 2020 and 2021, when rates were between 1.39% and 2.49%, interest rates are still high for the average buyer.

On top of that, Canada’s economy is shifting. The unemployment rate rose to 7.1% in August — the highest since 2016 outside of the pandemic — and US trade policy could slow economic growth further.

RBC reported that $125B of Canadian economic activity is tied to sectors exposed to trade disruptions. In the second quarter of 2025, real gross domestic product shrank by 0.4%, largely due to a significant decline in the export of goods.

All of these factors weigh on prospective buyers and sellers’ minds when debating whether to enter the real estate market this fall.

Structural Housing Challenges will Continue to Shape The Fall Market

The household saving rate declined from 6.2% in Q2 2024 to 5.0% in Q2 2025, according to new Statistics Canada data. As disposable income shrinks and the cost of living rises, the barrier to homeownership grows.

“The core economic pressures in our housing market remain, and we still don’t have enough housing starts to meet demand,” says Lysenko. “While inventory has improved, affordability continues to be a challenge for many. Heading into the fall, we’re likely to see demand continue, but only among buyers with the financial flexibility and certainty to manage the carrying costs.”

Inventory has risen significantly over the last three years in major markets. Notably, the number of active listings nearly tripled in Toronto from January 2023 to August 2025. In Vancouver and Calgary, active listings have increased by 117% and 171% respectively.

While the boost in supply has helped cool prices down in some areas, borrowing costs remain elevated, and home prices are still higher than the average buyer can manage. Without a significant increase in affordable housing stock, the cost of homeownership remains out of reach for many.

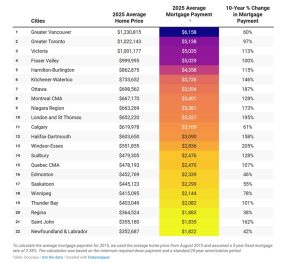

Average Mortgage Payments Across Canada

Mortgage payments were calculated using the best posted 5-year fixed rate from Ratehub (3.94%), assuming a minimum down payment and a 25-year amortization period. Calculations are based on the average home price in August 2025.

Average mortgage payments across Canada are substantially higher than they were ten years ago. In much of Ontario, average mortgage payments have increased by over 100% since 2015, with Windsor-Essex seeing a 205% jump.

Average mortgage payments across Canada are substantially higher than they were ten years ago. In much of Ontario, average mortgage payments have increased by over 100% since 2015, with Windsor-Essex seeing a 205% jump.

Even affordable havens like Saint John and Sudbury are feeling the pinch. The average mortgage payment in Saint John increased by 162%, while in Sudbury it’s up by 128%.

With that being said, buyers who are financially prepared to enter the market this fall may find more conditions in their favour than in the past several years. As inventory rises and prices show signs of continued softening, there’s more room to negotiate and more opportunity to find a good deal.

Zoocasa’s Fall 2025 Housing Market Predictions : Opportunity or Uncertainty? by MacKenzie Scibetta | zoocasa

Recent Comments