Condominium investors in Toronto and Vancouver are a stable, careful, mostly small-scale group, according to Canada Mortgage and Housing Corporation’s latest Condominium Owners Report. Those homeowners who own a secondary condominium, meaning one that they bought as an investment, are most likely to own it in the city where they live, and most often bought it for the rental income it provides. Most also expect to keep the second condo for at least five years.

The number of condo owner-investors is less than a quarter of all condo owners. The majority (76.5%) own only the condo in which they reside. The 23.5% who own a secondary condo are in the market for the long term, according to CMHC. Only 8.4% of investors said that they intended to keep the property for less than two years. This number is down from last year, when 10.1% planned to flip a condo property.

Most of the investors, three-quarters of whom own just one secondary unit, have no plans to buy more units over the next year. A small number of investors, 10%, have three or more secondary units.

Investors are fairly well off, judging by their mortgage financing profile. Slightly more than half (53%) had a mortgage on their most recently purchased secondary unit, but almost 20% did not need a mortgage to buy their last secondary unit. Of those who did, 45% had down payments of 20% or more. The most common mortgage type among condo investors, as among Canadian homebuyers in general, is the five-year fixed-rate mortgage.

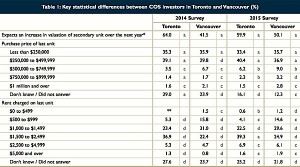

Most investors are optimistic about their properties’ market value increasing. More than half of Toronto investors (59%) expect their properties’ value to increase, while 4.8% foresee a decrease. One-third think the value will remain unchanged. Toronto investors are slightly more likely than their Vancouver counterparts to expect the value of their units to increase. Monthly sales figures from the Toronto Real Estate Board over the past several years bear out this expectation. Those who purchased at the lower-to-mid-price range (less than $250,000 to $499,000) are more likely to expect the units to increase in value over the next year.

Average rents charged by Toronto investors are mostly in the upper end of the $1,000– $2,500 range. Almost 40% of Toronto investors charged $1,500–$2,500 in 2015, an increase of about 3% over the previous year.

The results reported in the Condominium Owners Report are based on responses from 42,681 households surveyed in Toronto and Vancouver.

Condo Owners Report Shows Stable, Careful Investors at Work by Josephine Nolan | Condo.ca

Recent Comments