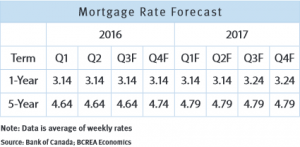

The record-low mortgage rate environment seems poised to continue, according to a recent forecast from the British Columbia Real Estate Real Estate Association.

“Given the current outlook for economic growth, the likelihood of the Canadian economy returning to its full-potential level before 2018 remains low,” BCREA said in its forecast. “That means that inflation should remain below target over the next two years, keeping the Bank on the sidelines for the foreseeable future.”

It’s been 14 consecutive months of stability for the Bank of Canada’s benchmark for its overnight rate, and mortgage rates have remained relatively steady as well.

The Canadian economy has recovered somewhat from 2015, but not enough to warrant a hike to the BoC’s rate. That means homebuyers and, indeed, investors will continue to benefit from record-low rates.

The BCREA expects the economy to grow 1.5% for the rest of the year before increasing to 2.3% in 2017.

Despite this, short-term rate decisions will be based on factors outside the country, according to the association.

“The outlook for mortgage rates continues to hinge on factors external to Canada, namely the direction of oil prices and the direction of US monetary policy. With regard to oil, prices have moved higher recently, but still remain well short of levels from two years ago. Nevertheless, rising prices should provide a modest lift to incomes in key oil producing provinces while diminishing the need for further loosening of interest rates by the Bank of Canada.”

Good Times for Investors to Continue by Justin da Rosa | Canadian Real Estate Wealth

Recent Comments