Experts say it’s too early to know the full impact of BC’s recent tax on foreign homebuyers in Metro Vancouver, but one forthcoming figure could provide a clue.

“I think what may grab the market’s attention will be again on the sales side,” Robert Hogue, a senior economist with RBC, tells BuzzBuzzNews.

“But certainly I will look very closely at the supply side, the listings side,” he continues, awaiting the release of August’s resale housing market figures from the Real Estate Board of Greater Vancouver (REBGV), expected early September.

On August 2nd, the BC government began charging foreign nationals and foreign corporations a 15% property transfer tax on residential real estate purchases.

In the days immediately following, West Vancouver home sales have plummeted, according to one realtor’s analysis of MLS numbers, Global News reports.

Just three homes changed hands in West Vancouver from August 1st to the 14th. That’s a steep drop from the 52 transactions recorded over that period a year ago and the bearish finance blog Zero Hedge took this as a sign that “the Vancouver housing bubble had popped.”

But Andy Yan, Simon Fraser University’s acting director for its City Program, says more time is needed to gauge the implications of the tax on local real estate.

“It’s really hard to say if it’s just cooling off,” he tells Global. “It could be that everybody who could or would buy at those really high prices a couple months ago are now already in, and now we just really see how the market is retracting itself,” he adds.

RBC’s Hogue isn’t sure a “significant” drop in sales to foreign nationals would be enough to cool Vancouver’s market overall. “The big question to me… has to do with the supply side,” he says.

Hogue says listings are an important indicator of the impact this new tax is having on local real estate partly because an increase in resale properties on the market may mean investors are looking to offload assets.

“If [supply] remains quite stable, I think the odds of outright price declines are low,” he says.

The number of new listings in Vancouver rose 2.5% in July compared to activity recorded during the same month last year, according to REBGV’s latest figures.

“Now, if we see… more listings showing up on the market, then we may see price declines showing up much quicker than we otherwise would anticipate,” Hogue explains.

In recent months Vancouver’s sales-to-active listings ratio has been falling, hitting 38.6% in July, generally among the slowest months for real estate activity in the year.

The ratio is calculated by dividing sales by active listings. REBGV says the ratio is “a measure of balance between supply and demand in the housing market.”

While the ratio is wilting, it still has a ways to go before the market favours buyers, REBGV suggests. “Generally, analysts say that downward pressure on home prices occurs when the ratio dips below the 12% mark,” the board said in its July report.

The increase in year-over-year July listings was the result of fear rather than anything else, says Morgan Browne, a partner at Oakwyn Realty Vancouver.

“It’s definitely safe to say when that foreign tax came out there was a pressure on listings, because I think the sellers are either misinformed or don’t have the education behind it,” she tells BuzzBuzzNews.

“Because the media has kind of said, ‘Okay, everyone that’s purchasing is really a foreign buyer, it was a little bit of a pressure for a majority of people dealing in July and moving into August,” she adds.

Browne says the biggest impact the tax is having has been on listings.

“It’s just because sellers are really in the mindset that this is the end of the high — it’s got to end sometime,” the real estate agent says.

Like Hogue, BMO Senior Economist Robert Kavcic will also be taking note of where listings stand next month. “We always do,” he says in an interview with BuzzBuzzNews.

“What’s interesting is that the market balance has softened a bit just in the five or six months leading up to the tax,” he adds, noting sales have been declining and, also like Hogue, he observes listings are on the rise.

“We went from an environment where literally almost every new listing was getting absorbed within the month to now something that’s still pretty tight but a lot closer to what is typical for the city — and that was before the tax took hold,” he says.

“Depending on what kind of impact that has, we could see the pace of price growth in some markets soften quite a bit,” Kavcic adds.

However, falling home prices aren’t something Kavcic expects, even if the provincial government’s real estate tax does manage to quell foreign-buyer activity.

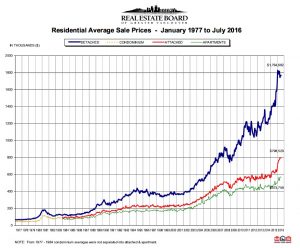

In July, the benchmark price of a Metro Vancouver home was $930,400, up 32.6% from a year ago.

Such annual gains are unsustainable, Kavcic says, but he’s calling for price “deceleration” rather than declines at the moment.

In a time of low interest rates, income growth around three-to-four per cent and strong demographic and supply fundamentals, Kavcic says price growth of “something close to 10% year-over-year” could be supported.

“It’s pretty tough to say, it’s pretty tough to put a precise number on it,” he admits of what the post-tax market will look like.

“Certainly you can’t have prices growing at 30% year-over-year forever.”

Forget Sales Drops, This Stat Will Hint at How the Foreign Homebuyer Tax Really Affects Vancouver Housing by Josh Sherman | Buzz Buzz Home

Recent Comments