Metro Vancouver’s new foreign buyers tax came into effect on August 2nd, and since then there’s been much discussion of the impact it could have on home sales and prices in the area. The BC government has now provided the first data on foreign investment in residential real estate since the tax was introduced, and it confirms what many experts anticipated — foreign buyer activity in Metro Vancouver has seen a huge drop since the beginning of August.

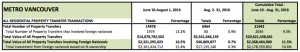

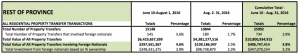

Released September 22nd, the data shows that from August 2nd to 31st only 0.9% of residential real estate transactions in Metro Vancouver involved foreign buyers. Those transactions were valued at $46.9 million. And, as a result of the new tax, the transactions generated $2.5 million in revenue for the BC government. In contrast, foreign buyers were involved in just over 13% of Metro Vancouver residential real estate transactions from June 10th to August 1st.

“I think it is fair to say we have had an impact. That was the impact we wanted to have,” BC Premier Christy Clark said Thursday. She added that her “hope is that many of those units that would have sold to foreign buyers, will now be sold to British Columbians.”

June 10th is the day that the BC government began collecting data on foreign buyers on, and from then until August 31st, 9.3% of Metro Vancouver residential real estate transactions valued at $2.3 billion involved foreign buyers. According to the BC government, July 29th, the last day sales could be registered before the tax was put in place, was by far the busiest in terms of foreign buyer activity — on that day, foreign buyers were involved in 55% of Metro Vancouver residential real estate.

While it seems clear that the new tax is having an effect on foreign buying in Metro Vancouver, the BC government has emphasized that “it will take more time to conclude what effect the additional property transfer tax on foreign buyers has had on the real estate market.” Similarly, Clark said, “[i]t is really early days. We have three months of data. You’ll see those numbers change.”

Even so, some are convinced the tax was a good move, even in these early days. Since it was announced there have been rumblings that a similar tax could be instated in Toronto, and in a Thursday article for the Financial Post, former Canadian Finance Minister Joe Oliver endorsed that idea. While he admitted he is “outside [his] comfort zone in recommending a tax hike,” he sees dire consequences in letting foreign buying continue to drive up housing demand and prices in the city.

“Increased foreign buying is going to exacerbate an overheated real estate market, to the detriment of all Torontonians and at risk to the broader economy,” he said.

In terms of what’s next in BC, the government plans to continue to collect data on foreign buyers. Other measures to regulate the province’s real estate industry are also underway. Earlier this week, Vancouver’s City Council voted to move forward to public consultations on a proposed tax on empty homes in the city. Also this week, Michael Noseworthy was announced as the province’s new real estate superintendent; he has served in a similar capacity in the Yukon and will take the post on October 19th.

Foreign Investment in Metro Vancouver Real Estate Down Dramatically Since Introduction of New Tax by Charlotte McLeod | Buzz Buzz Home

Recent Comments