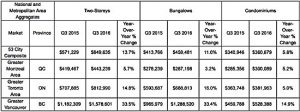

Recently announced government measures to rein in Canada’s residential real estate market have not yet had much impact on the way the market has performed, both in terms of sales numbers and prices. The latest Royal LePage House Price Survey shows that nationally, the price of a home in Canada in the third quarter increased 12% compared to one year ago, rising to $545,414, as measured by the Royal LePage National House Price Composite. The price of a two-storey home rose 13.7% to $649,635, and the price of a bungalow increased 11%, to $459,481. The average condominium price rose 5.8%, to $360,679.

Even in Vancouver, where a new foreign buyers tax of 15% was imposed in early August, the third quarter was one of “unsustainably high price appreciation,” according to Royal LePage president Phil Soper. In one West Vancouver enclave, the median value of homes rose nearly 40%. Overall, Vancouver led the country in price appreciation, prices rising 30.6% in the third quarter, in what may be “a final hurrah for this expansionary cycle.” Sales activity has slowed, Soper said, and slower sales generally lead to moderating prices. Nationally, the market is poised for cooling, said Soper, but it is unlikely to happen this year or even through the spring of next year. Real estate markets remain healthy, even in the hardest hit oil patch regions.

Nationally, our real estate markets remain healthy, with home values showing modest to strong (yet rational) price appreciation in almost every Canadian city. Even in the hardest hit oil patch regions, prices have held up well, with small single-digit declines, year-over-year.

The first of the new measures announced by Finance Minister Bill Morneau does not take effect until October 17, followed by a second on November 30. Soper says that Canadian consumer confidence “suffered a direct hit” when the measures were announced, but it appears they are adjusting quickly, and that fears of a “hard correction” were unwarranted. In Toronto, one of the main target markets for the tougher mortgage lending requirements, prices climbed 12.1% in the third quarter. The same was true in eight of the surrounding GTA municipalities. In Oshawa, prices surged 26%, to $453.975, and in Richmond Hill by 25.7% to $1,074,829.

Analysts such as Fitch Ratings believe, however, that Morneau’s new eligibility requirements for insured mortgages will “temper” the housing market, which it has said is overvalued by about 25%.

The real effects of the new mortgage eligibility rules won’t be felt until after October 17, when Canadians will for the first time face the new mortgage borrowing “stress test.” Regardless of what mortgage rate a borrower can get from a bank, he or she will have to qualify for the much higher rate of 4.64%. For a borrower with a household income of $100,000, this effectively reduces the amount of mortgage he qualifies for by 20%. It is expected that this tightening of the mortgage money could have a large impact on the housing industry, including on home builders. Until actual numbers are in following implementation, it is impossible to say how severe the impact of this move will be.

Meanwhile, regarding another measure possibly coming from the Department of Finance, increased risk sharing by Canada’s banks, the banks have made it clear that they are unhappy. As it is now, the federal government bears 100 per cent of the responsibility for any CMHC-insured mortgage, a situation that is reportedly unique in the world. Currently, the federal government backs about $450 billion in insured mortgage debt. If a mortgagor defaults and loses his home, the taxpayer absorbs any loss in the disposition of the home. Lenders bear none of the risk, a position they are keen to preserve. Mortgage default numbers are so low in Canada, the banks argue, that forcing banks to share the risk is not even worth the cost.

The risk-sharing envisioned by the Department of Finance, a policy option that is in line with the government’s stated aim of reducing its own exposure to the housing market, could involve banks and mortgage companies like Genworth paying a deductible if a loan goes bad. Another possible approach would be for lenders to pay a fee to insurers to manage any loss, or taking a portion of the loss themselves. Such measures, the banks say, will only lead to higher mortgage rates, higher fees, and possibly drive borrowers to unregulated lenders.

The Canadian Bankers Association argues that mortgage underwriting in Canada is strong and does not need measures such as a deductible imposed on it.

The finance minister has not yet announced any policy changes regarding risk sharing, saying that any changes will be carefully thought through, with feedback from the industry.

National Housing Markets Healthy Pending Changes to Mortgage Eligibility Rules by Josephine Nolan | Condo.ca

Recent Comments