What impact will the recent mortgage rule changes have? And what about the potentially volatile Trump effect?

“The change in qualification rules for homebuyers means that the posted 5-year rate has become much more binding and will now have a more immediate and impactful effect on mortgage demand than in the past,” the British Columbia Real Estate Association said in its December rate forecast. “Additionally, less publicized changes such as eliminating the availability of insurance on mortgages with greater than 25-year amortizations or potential default insurance risk sharing, are putting upward pressure on rates offered by lenders.”

This is nothing new to real estate professionals.

However, the association also believes the recent presidential election could be a major factor in shaping the future of long-term interest rates.

President-elect Trump’s campaign promises included a promise to increase the country’s deficit through tax cuts. Rates will be impacted if he does, indeed, make good on that promise.

“If Trump’s plans are more than just empty rhetoric, the US Treasury will need to dramatically increase borrowing in international bond markets,” BCREA said. “That means that the Canadian government, which has deficit plans of its own, will be forced to compete much harder for global capital by offering higher interest rates to investors.”

According to the association, bond markets have reacted in a way that suggests Trump will increase the deficit.

Yields on five- and 10-year bonds in both the US and Canada have increased nearly 50 basis points since the election.

And because mortgage fixed rates are closely tied to the bond market, mortgage rates have also seen a spike.

So the barrier to purchase has already been increased. It could, however, rise even further.

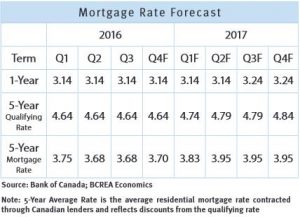

“The five-year qualifying rate could see a minor uptick in the next one to two quarter given the recent increase Canadian five-year Government bond yields, though the fundamental change in the importance of the qualifying rate presents a challenge to forecasting. For that reason, we are now also forecasting the average contracted five-year rate, which reflects discounts offered from the qualifying rate.

“We anticipate that as bond yields move higher in the next year and new mortgage regulations squeeze margins, banks will raise their current offered rates on five-year mortgages by roughly 20 basis points to just under four per cent on average.”

Still, nothing is yet set in stone.

Due the to the volatility of the incoming presidential administration and its effect on trade and taxes, there could be downside risk to the overall economy.

Which could lead to a Bank of Canada rate slash.

Long-term Rate Forecast Revealed by Justin da Rosa | Canadian Real Estate Wealth

Recent Comments