Canada has seen the fastest house-price growth among the major economies of the G20, a new report says. But with Toronto’s housing market entering a slowdown, it’s unlikely the country will repeat the trick in the future.

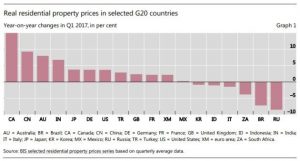

The Bank for International Settlements (BIS) reports that global house prices rose at a pace of around 4 per cent in the first quarter of this year, in both the advanced economies and the emerging economies of the G20.

Canada’s price growth more than quadrupled that rate, growing 16.2% in that time. The Great White North came in ahead of second-place China and third-place Australia.

Much of that meteoric rise came from Greater Toronto, which experienced rapid house-price growth in the first quarter of this year. In March, the last month of the quarter, Toronto’s average house price was up 33 per cent compared to a year earlier.

But all that came to a sudden halt in April, when Ontario’s provincial government introduced a dozen new measures for the Greater Golden Horseshoe area designed to cool prices. Among them is a 15% foreign speculators’ tax and expanded rent controls.

The average house price in Toronto has been in decline ever since. According to preliminary data from the city’s real estate board, the average price of a detached home in the Greater Toronto region fell back below $1 million in August.

Tougher federal mortgage rules are also helping to soften the market, inside and outside of Toronto. The federal Liberals last fall introduced a stress test for borrowers of insured mortgages, requiring them to qualify at a the Bank of Canada’s posted mortgage rate, which is roughly two percentage points higher than the rates offered by lenders today.

That stress test has had a notable impact on the market. Canada Mortgage and Housing Corp. reported this week that the volume of mortgages it insures plunged by 33% in the second quarter of this year, compared to the same period last year.

Rising interest rates promise to add further pressure to house prices. The Bank of Canada hiked its key lending rate in July for the first time in seven years, and mortgage lenders reacted by hiking their own rates.

When It Comes to Soaring House Prices, Canada’s #1 by Daniel Tencer | Yahoo Finance

Recent Comments