Canadian home sales took a dip last month, as the housing market adjusted to a new mortgage stress test for uninsured borrowers. But according to one house price index, prices remained fairly buoyant.

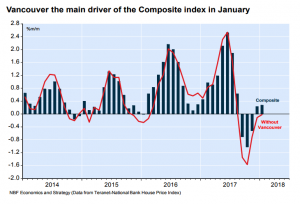

January saw a 0.3% month-over-month increase in the Teranet-National Bank Composite National House Price Index, and a 8.7% year-over-year gain.

It’s a softer increase than June’s record 14.2% gain, and the lowest increase since May 2016.

According to National Bank senior economist Marc Pinsonneault, the increase was primarily driven by Vancouver’s tight housing market.

“On a year-over-year basis, Vancouver’s index for condos surged 23%, while the index for other types of dwellings rose 13.5%,” writes Pinsonneault, in a recent note. “The fact is that Vancouver’s home resale market remained tight even after the introduction of a tax on acquisitions by foreigners.”

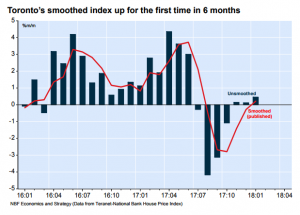

Meanwhile, Toronto’s market was cooler than in previous months, with an increase of just 0.2%.

“Toronto’s index was up in January for the first time in six months,” writes Pinsonneault. “This firming of home prices in Toronto might reflect a rush to buy with pre-approved mortgages granted before more stringent rules on qualification for an uninsured mortgages were applied starting January 1.”

But Pinsonneault also warns that it’s too soon to say whether Toronto prices will stay on the up and up, as February’s index will give a better idea of how the market has adjusted to the new mortgage rules, and an interest rate hike.

“With further increases in mortgage rates still to come — according to the Canada Mortgage Housing Corporation posted five-year rates were at 4.14% in January against a low of 3.59% last May — it is premature to conclude that home prices have definitely turned a corner in Toronto.”

Despite Slowing Sales Across the Country, This House Price Index Continues to Rise by Sarah Niedoba | Buzz Buzz Home

Recent Comments