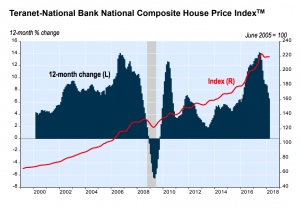

A major index tracking Canadian home prices flattened out in March and, according to one economist, it could be a sign that the housing market is finally balancing out.

The Teranet-National Bank Composite National Home Price Index was flat in March, following a 1.9% decline in February.

“Without Vancouver, the Composite Index would have declined in March,” writes National Bank senior economist Marc Pinsonneault. “Apart from Vancouver and Victoria, March indexes were below their recent peak in all regions.”

According to Pinsonneault, the Toronto and Vancouver markets disportionately affect the index, and the flat reading in March reflects the fact that both have begun to balance out.

“The decline [in March] was the most obvious in Toronto [which has dropped 7.3% since July],” he writes. “This drop was likely triggered by Ontario’s implementation of the 15% [foreign buyer tax] followed by stricter rules for qualification for a mortgage and a rise in mortgage rates.”

Pinsonneault writes that these changes have balanced out the Toronto market, while the Vancouver market is likely to follow suit, after an expansion of its foreign buyer tax was announced last month. The result? National home prices will remain relatively even in the coming months.

“With the two most important Canadian markets now in balanced territory or nearing it, a soft landing is the most likely outcome for the Canadian residential market,” he writes.

This Housing Price Index Shows That The Canadian Housing Market is on Its Way to Balancing Out by Sarah Niedoba | Buzz Buzz Home

Recent Comments