The impact of new mortgage qualification hurdles introduced in January “cast a shadow” over the Canadian housing market in April, with sales down 2.9% across the nation from March, and the average sale price softening 11.3% to $495,000.

The Canadian Real Estate Association reports sales in April clocked at 13.9% lower than in 2017, the lowest level in five years, as activity declined in 60% of all local markets, and hover 6.9% below the 10-year average.

The MLS Home Price Index, while up 1.5% from 2017, marks the 12th consecutive month of price gain deceleration, and the smallest increase since 2009, the association states. However, stripping the Greater Vancouver and Greater Toronto Area markets out of the equation removes $109,000 from the national average price, and reduces the annual decline to just 4.1%.

CREA says this has mainly been impacted by softer prices in the Greater Golden Horseshoe, where home values are rising month over month, but still trend below last year’s prices by double digit percentages.

New Mortgage Rules Are Taking Toll on Buyers

CREA points the blame squarely at Guideline B-20, which requires all new and refinancing borrowers to qualify for their mortgage at the Bank of Canada’s benchmark rate (currently 5.34%), or their contract rate plus 2%, whichever is higher, depending on the size of their down payment.

“The stress-test that came into effect this year for home buyers with more than a 20% down payment continued to cast its shadow over sales activity in April,” says CREA President Barb Sukkau.

Sukkau adds that the impact varies by region, as measures designed to cool Canada’s largest and most competitive markets have had disproportionate effects for smaller markets that did not require aggressive correction.

Gregory Klump, CREA’s chief economist, says this is the fallout the association initially warned of when the mortgage stress test was first introduced.

“This year’s new stress test has lowered sale activity and destabilized market balance for housing markets in Alberta, Saskatchewan and Newfoundland and Labrador provinces,” he says

“This is exactly the type of collateral damage that CREA warned the government about. As provinces whose economic prospects have faced difficulties because they are closely tied to those of natural resources, it is puzzling that the government would describe the effect of its new policy as indented consequences.”

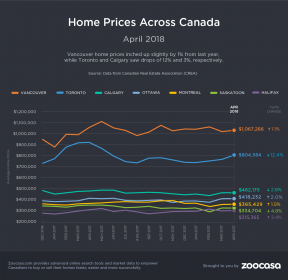

April 2018 Home Prices Across Canada

However, while sales continue to fall year over year, fewer homes listed for sale kept most markets from falling into buyers’ territory; inventory is down 4.8% in April – a nine-month low for the month, and 12% below the monthly average.

That’s led to a sales-to-new-listing ratio of 53.7% nationally, slightly firmer than the 52.6% in March. This ratio, which is calculated by dividing the number of sales by the number of new listings hitting the market over a specific time frame, indicates the level of balance, or competition, in a given region. A ratio between 40 – 60% is considered a balanced market, with below and above that threshold indicating buyers’ and sellers’ markets, respectively.

April Price Growth by Home Type

Condo apartments continue to experience the strongest appreciation, with prices up 14.7% year over year, followed by townhouses at an increase of 6.5%. However, single-family home prices continue to decline, with one-storey house prices down 1.1%, and two-storey down 4.8%.

April Price Growth by Region

British Columbia : Composite prices are still rising in BC’s Lower Mainland, recovering from a foreign buyer tax-induced dip in 2016. Prices are up 14% in the Greater Vancouver region, 22.7% in Fraser Valley, 14 per cent in Victoria, and 20% throughout the rest of Vancouver Island. CREA says this is mainly driven by increased demand for the most affordable home types, such as condos and townhouses.

Ontario : Prices have slowed considerably year over year in the Greater Golden Horseshoe, and remain above 2017 levels only in Guelph, by 5.7%. The rest of the region, however, has experienced declines, down 5.2% in the GTA, 8.7% in Oakville-Milton, and 8.4% in Barrie and District. “This reflects rapid price gains recorded one year ago and masks recent month-over-month price gains in these markets,” CREA’s report states.

In Ottawa, which has been enjoying renewed demand for its single-family homes, prices are up by 8.4%, led by two-storey houses, up 9.4%.

Prairies : Price growth continues to be flat in Calgary and Edmonton, at plus-0.1% and down 0.9%. Regina and Saskatoon both continue to see year-over-year declines, at 6.5% and 3.4%, respectively.

Eastern Canada : Montreal continues to be a growing hot spot, with prices up 6.3%, driven by a 7.3% increase in single-family homes. Greater Moncton prices are up 4.2%, led by a 5.6% in one-storey single family homes.

CREA : National April Home Sales Fall to 5-Year Low by Penelope Graham | zoocasa

Recent Comments