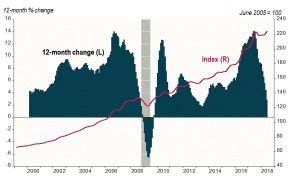

In June the Teranet–National Bank National Composite House Price Index™ was up 0.9% from May. Though large at first glance, the increase was the third-smallest for June in the last 14 years. If we ignore the seasonal component of monthly variations, we cannot speak of a soaring index. The latest run of monthly increases is merely a recovery of ground lost in the second half of last year. The composite index is now barely above its previous peak of August 2017.

As in May, prices were up in 10 of the 11 metropolitan markets surveyed, led by Ottawa-Gatineau (2.0%), Hamilton (1.8%), Edmonton (1.5%), Victoria (1.3%), Toronto (1.2%) and Halifax (1.0%). The Toronto rise was the smallest since 2008 for a month of June. The Quebec City index rose apace with the countrywide average of 0.9%. Gains were smaller in Montreal (0.7%), Vancouver (0.6%) and Calgary (0.6%), and the index for Winnipeg was down 1.0% on the month. The rise in Vancouver was the fourth-smallest since 2001 for a month of June.

Over the first half of the year the Toronto index rose at an annual rate of 5.7%. For the condo segment the rate was 12.1%, for other housing only 2.9%, reflecting a tight seller’s market for condos. The Vancouver story is similar: condo segment up 17.6% annualized since last September, other dwelling types up 4.9%.

Five of the 11 markets reached a new high in June: Vancouver, Victoria, Montreal, Halifax and Ottawa-Gatineau. The market furthest from its previous peak was Toronto, down 4.8% from its reading of last July.

Teranet-National Bank National Composite House Price Index™

In June the composite index was up 2.9% from a year earlier, the smallest 12-month rise since October 2013 and a 12th consecutive deceleration from the record 12-month gain of 14.2% last June. The January 12-month rise was led by Vancouver (13.3%), Victoria (9.3%), Ottawa-Gatineau (4.7%), Montreal (3.6%) and Halifax (3.2%). The 12-month gain was slim in Winnipeg (1.3%), Quebec City (0.7%), Calgary (0.3%) and Edmonton (0.2%). Indexes were down from a year earlier for Hamilton (−0.4%) and Toronto (−2.8%).

In addition to the Toronto and Hamilton indexes, included in the composite index, indexes exist for the seven other urban areas of the Golden Horseshoe. In June, three of these seven (Barrie, Kitchener and Oshawa) were, like Toronto and Hamilton, below their various peaks of July, August or September 2017. The other four (Guelph, Brantford, St. Catharines and Peterborough) reached new peaks. Indexes not included in the composite index also exist for seven markets outside the Golden Horseshoe, five of them in Ontario and two in BC. The indexes for these last two, Abbotsford-Mission and Kelowna were, like those for Vancouver and Victoria, at new peaks in June. The same was true of the indexes for Thunder Bay, Windsor, London and Kingston in Ontario.

Click here for the full report including historical data.

Recent Comments