To hear the Bank of Canada tell it, the Canadian housing market is “stabilizing.”

That’s what the central bank said of home sales activity when it once again hiked the overnight interest rate, which influences the mortgage marketplace, by 25 basis points in October.

But CIBC Deputy Chief Economist Benjamin Tal and his colleague Royce Mendes, a senior economist, aren’t so sure.

“The Bank of Canada also keeps arguing that the worst is now behind us and that housing markets are stabilizing. But, from our vantage point, it’s difficult to agree,” reads a report authored by Tal and Mendes.

In the report, entitled Where Are We in the Canadian Housing Slowdown, the two economists lay out why they find it “difficult to agree” with the central bank.

Tal and Mendes suggest the Canadian housing market has yet to fully absorb the effects of higher interest rates, and that prices won’t begin to balance until sometime next year.

“The central bank’s own workhorse model says it takes six quarters before the full impact of any rate hike is felt in the economy,” they point out.

After fostering a period of historically low interest rates to boost the economy, the Bank of Canada last year started gradually pulling up the overnight rate.

This October marked the fifth time since July 2017 that the bank hiked the overnight rate by 25 basis points. So there is reason to believe the effects of monetary tightening haven’t worked their way through the market yet, the report suggests.

The current overnight rate is now 1.75 percent, with more hikes widely expected.

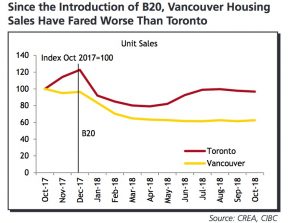

Tal and Mendes also suggest that Vancouver hasn’t finished adjusting to fallout from the B-20 rules, a federal policy move that subjects uninsured-mortgage applicants to stress testing.

Basically, borrowers who could previously sidestep stress testing, which requires applicants to qualify for a higher mortgage rate than they are signing on for, by putting down 20 percent for an uninsured mortgage.

Vancouver has yet to see a rebound in sales following the government’s introduction of the B-20 rules in January, and as one of the country’s largest and least affordable markets, the implications are national.

“It appears that Toronto is stabilizing while Vancouver is still correcting,” the report reads. “Looking ahead, we expect more of the same. Population growth in Vancouver has been lagging behind Toronto’s over the past two years.”

Then there is the much-talked-about rise in Vancouver’s supply of condos. The number of new units that are completed but unsold continues to climb, the report says.

The adjustment in the Canadian housing market in general, and in Vancouver and Toronto in particular, is not over yet,” write Tal and Mendes. “But, we believe that market forces suggest prices will find equilibrium next year.”

Canada’s Central Bank Says The Housing Market is Stabilizing. These Economists Aren’t so Sure by Josh Sherman | Livabl

Recent Comments