June saw just over 40,000 houses sold, dipping below the 10-year monthly average, with the number of transactions coming in -23.9% below last year’s record setting figures, according to the Canadian Real Estate Association (CREA). The number of homes changing hands also dipped month-over-month by -5.6%,

Many attribute the decline in sales to the rising interest rates, but other factors include; a wait-and-see approach towards housing prices, the rising cost of living with record high inflation, buyer fatigue or even rising gas prices, as a longer commute would provide uncertainty about where to live.

Available inventory has seen an improvement in the last couple of months, and June followed that trend, with the number of newly listed homes climbing 4.1% month-over-month. A jump in new supply in Montreal was a major factor driving the overall growth rate whilst new listings in the GTA and Greater Vancouver did see small declines. There were 3.1 months of inventory recorded on a national basis, and while still historically low it is an increase from the tightest conditions ever recorded at the start of 2022.

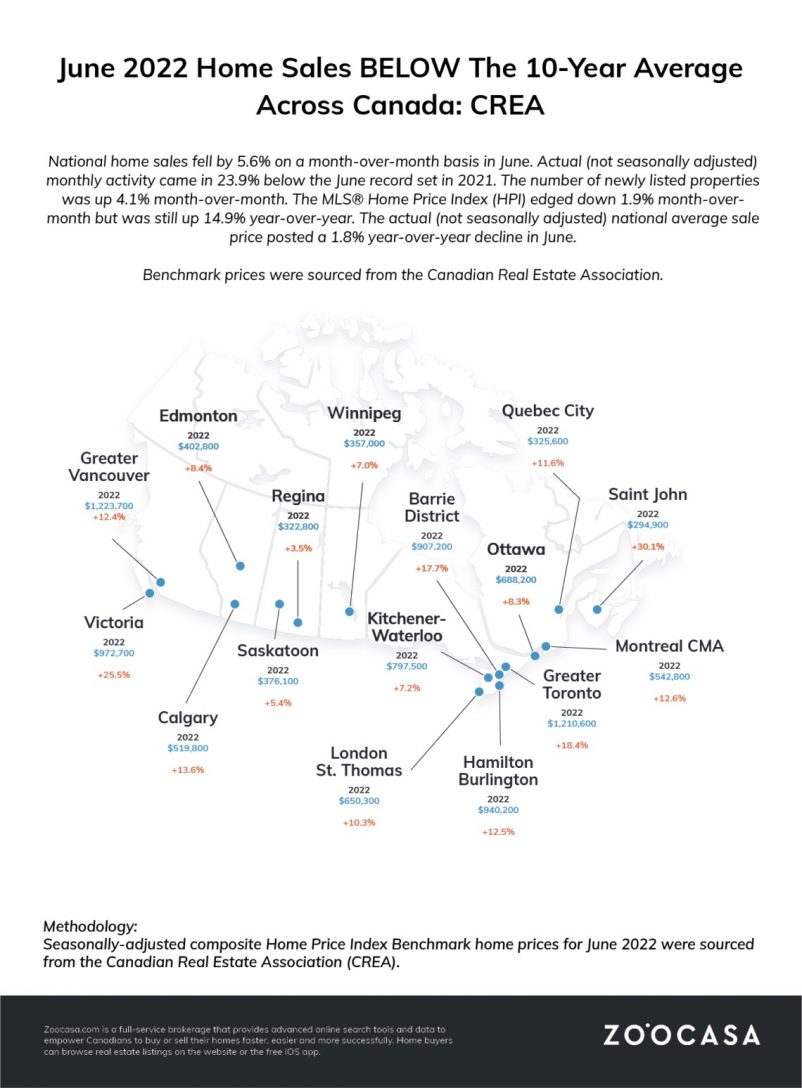

With slightly higher stock comes slightly lower prices. While the seasonally adjusted aggregate MLS Home Price Index Benchmark Price is still just over 15% higher year-over-year, there are noticeable month-over-month declines. The current average home price is $807,400, -3.3% lower than it was three months ago and -1.9% lower than in May.

Mortgage qualifications having a large influence on the market

While the lack of supply was driving up house prices in earlier parts of the year, the cost of borrowing has overtaken it as the dominant factor affecting the current housing market. As interest rates continue to rise it will have a direct impact on the amount buyers can qualify for under the stress-test. This will likely continue to have downward pressure on home prices for the remainder of the year.

Fixed and variable rate mortgages have different qualification criteria, and while variable rates adjust in real time, fixed rate mortgages have already factored in most of what the Bank of Canada is expected to do throughout 2022. Shaun Cathcart, CREA’s Senior Economist, says: “It’s no surprise to see people piling into variable rate mortgages at record levels, but probably not for the reasons they may have chosen them in the past. The 200 basis points plus the contract rate element of the stress test has, just since April, become much more difficult to pass if you want a fixed-rate mortgage. It made sense when rates were at a record low, but policymakers may want to assess if it continues to meet its policy objectives now that fixed mortgage rates are back at more normal levels.”

Some markets are becoming more affordable as prices drop more dramatically

Most of the monthly declines have been seen in markets in Ontario, while Quebec are just now beginning to show small signs of softening. Prices continue to be mostly flat across the Prairies, while they have eased in parts of British Columbia, with the East Coast being the major area of the country continuing to show price gains.

In Ontario, nearly every major area has seen some sort of price decline. Areas such as Simcoe and District, Northumberland Hills, Kawartha Lakes and London and St Thomas have seen price declines of over 6% month over month.

CREA : June 2022 Home Sales Below The 10-Year Average Across Canada by Daniel Crook | zoocasa

Recent Comments