The Bank of Canada (BoC) has raised its overnight lending rate again, this time by 50 basis points. This announcement marks its seventh and final interest rate increase of 2022. This year to date, the overnight lending rate has grown by a combined total of 4.25 basis points and Canadians with mortgages and home equity lines of credit are definitely feeling the impact.

Current Mortgage Options for Prospective Home Buyers

In a recent survey of more than 1800 Zoocasa readers, 35.8% of respondents strongly agreed that the increase in rates has had a negative impact on their interest in the real estate market. At the time of the survey, 60% also indicated that they plan to buy a home in the near future. Experts are predicting that the demand for housing will peak again soon as our population grows and newcomers to Canada look to buy housing, especially in densely populated areas including Toronto and the Greater Toronto Area (GTA). But when? This year overall has seen a decline of 23.2% in total real estate sales to date compared to 2021. With inflation still high and Canadians feeling the pinch, many are expecting a continued slowdown in the economy moving into 2023.

According to James Laird, Co-CEO of Ratehub.ca and President of CanWise mortgage lender, anyone shopping for a new mortgage will have three main options to choose from :

1. 5-year fixed rate : This is the right choice for anyone who thinks inflation will be persistent or anyone with tight household finances that cannot afford higher rates.

2. 5-year variable rate : This is the right choice for anyone who anticipates that the Bank of Canada is near the end of its rate hikes, and that it may even lower rates towards the end of 2023 and into 2024, as a result of a recession.

3. Short-term fixed rate : This is a similar strategy to taking a variable rate because it creates a quicker renewal, which will be beneficial to the borrower if rates decrease in the short term.

The Impact on Homeowners with Existing Variable Rate Mortgages

“The upcoming rate hike will mean even more Canadians will reach their trigger rate and trigger point. This only applies to those with a variable-rate mortgage with fixed payments. Borrowers with this type of mortgage have not been forced to increase their payments to the full extent of the rate hikes this year. Anyone with a variable-rate mortgage that has a variable payment has been forced to absorb the full impact of this year’s rate hikes,” explains Laird.

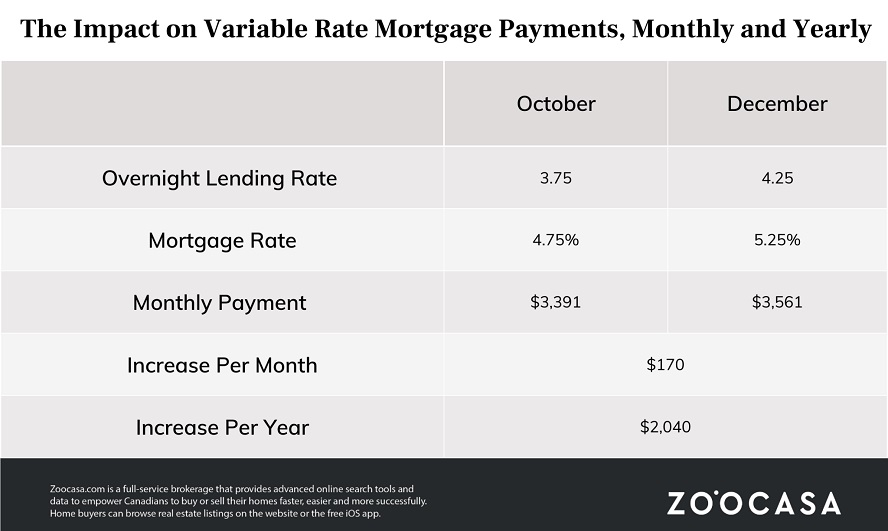

A homeowner that made a 10% down payment on a $644,000 home (the October 2022 average home price in Canada was $644,643) that secured a 5-year variable rate of 4.75% over 25 years has a monthly payment of $3,391. With the 50-basis point increase, their variable mortgage rate will increase to 5.25%, along with their monthly payment, now $3,561. The homeowner will now pay $170 more per month or an extra $2,040 per year in mortgage payments.

The Total Impact of Rate Hikes in 2022

Homeowners that secured a variable rate mortgage prior to the rate hikes have felt the impact all year. Laird explains: “In January of 2022, a homeowner who put a 10% down payment on a $748,450 home with a 5-year variable rate of 0.90%, amortized over 25 years would have a monthly mortgage payment of $2,585. December of 2022, if the Bank of Canada announces a 50-basis point rate increase (a total increase of 400 basis points since January), the homeowner’s variable mortgage rate will increase to 4.90% and their monthly payment will increase to $4,000.”. Overall, this means that the total impact to date for the homeowner is an additional $1,415 more per month or a 55% increase of $16,980 per year.

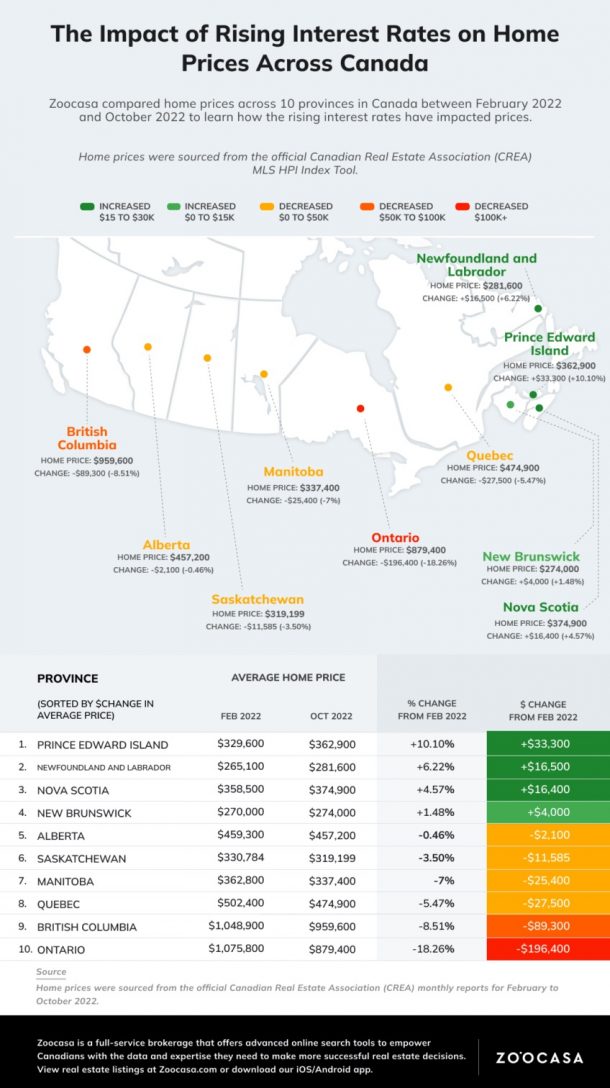

The impact is reflected in sales levels and real estate prices across the country as well. According to the Canadian Real Estate Association, residential sales activity across Canada in October was down 36% year-over-year. Average home prices have felt the same downward pressure. The average home price in Ontario has declined by 18.26%. Toronto and every city in the Greater Toronto area have experienced price declines of anywhere from 9% to 31% since February, read more about that here. However, these price declines are still not enough as Canadians from coast-to-coast have been priced out of the market due to rising interest rates.

Infographic : The Crushing Impact of BoC’s Interest Rate Hikes on Canada’s Housing in 2022 by Patti Cosgarea | zoocasa

Recent Comments