As we move into mid-February, this is typically when buyers and sellers begin preparing for the spring market by securing mortgage pre-approvals and prepping their homes for listing. Today, the Canadian Real Estate Association (CREA) released its January market report and the uncertainty that lingered in last year’s market has crept into 2023. “The big question on everyone’s minds after last year was what will housing markets do in 2023?” said Jill Oudil, Chair of CREA.

Slim Pickings for Buyers as Inventory Levels Remain Below Long-Term Average

Some would-be buyers were understandably discouraged by last year’s fluctuating market and chose to wait for more certainty. Now, many people that put off their home-buying plans are itching to make a move, “Many prospective buyers chose to wait on the sidelines while interest rates rose, but whether they were planning to move because they wanted a bigger home, a new neighbourhood, or to be closer to the office, they likely still need to move,” explains Lauren Haw, CEO and Broker of Record at Zoocasa.

CREA reports that new listings edged up by 3.3% month-over-month in January, but we are still sitting at historically low supply levels on a national basis. With 4.3 months of inventory at the end of January, inventory levels are about the same as in early 2020 and well below the national average of about five months. Although there is less to choose from, there are still deals to be found.

Market Conditions are Becoming More Affordable as Prices and Fixed-Rates are Decreasing

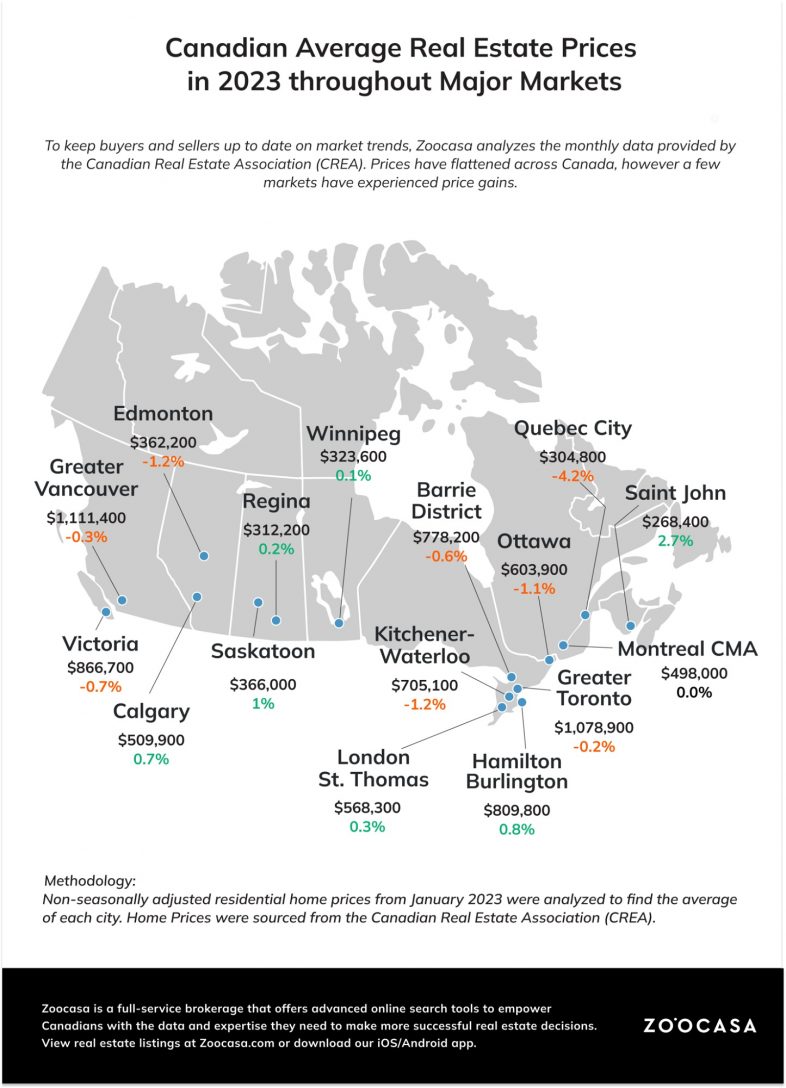

The national average home price was $612,204 in January, down 2.2% month-over-month and a staggering -18.3% compared to this time last year. This is good news for buyers who have been frustrated with dwindling buyer power heavily impacted by rising interest rates. “With the Bank of Canada increasingly signaling that rates are now at the top, it’s possible the spring market this year could also surprise, particularly in areas where prices have been stable or are now stabilizing. Buyers are likely feeling increasingly confident in taking on variable rate mortgages, and 2023 will probably be a good window of opportunity to be able to engage in a calmer home search and buying experience following the intense market conditions of the last few years,” said Shaun Cathcart, CREA’s Senior Economist.

For sellers that are preparing to list, it’s important to do your research and price your home correctly based on your local market. “Although the national average price is down compared to last year and the days of homes trading only on offer nights may be few and far between, there are many local markets like Hamilton-Burlington and London where demand is increasing, especially for homes that are priced correctly according to their local market conditions,” Haw continues. Although the number of sales pulled back in January, declining by 3% month-over-month, there are cities across the country where demand is growing. The Realtors Association of Hamilton-Burlington reported an increase in sales of homes priced below the $800,000 mark, and in London and St. Thomas, sales grew by 15% month-over-month, from 299 in December to 344 in January.

As the Canadian population continues to grow, it’s likely that inventory levels will remain tight, but that doesn’t mean that buyers and sellers alike shouldn’t make their move.

Home Sales Hit 14-Year Low, Supply Historically Short : Impact on Buyers and Sellers Preparing for Spring Market by Patti Cosgarea | zoocasa

Recent Comments