Housing prices declined in most markets across Canada this winter, however signs of an approaching spring emerged in February with month-over-month price declines getting smaller and sales increasing on a national level. As has been previously noted, February 2023 has many similarities with February 2019, meaning we might expect to see buyers coming off the sidelines as they did four years ago. What other trends might emerge in the spring? Here are 4 market predictions our real estate experts have their eyes on.

Sellers Will Come Out in Major Cities

A notable trend affecting the housing market recently has been low supply, with national inventory at just 4.1 months in February. However, we are expecting a shift in conditions as properties are getting ready for the market. “I predict an upswing in new listings in urban centres, where sellers have been holding back from listing for the past year. Strong absorption for the first few months of this year should prompt listings to start to come to market,” explained Lauren Haw, CEO of Zoocasa. Typically, we see an uptick in new listings after Easter.

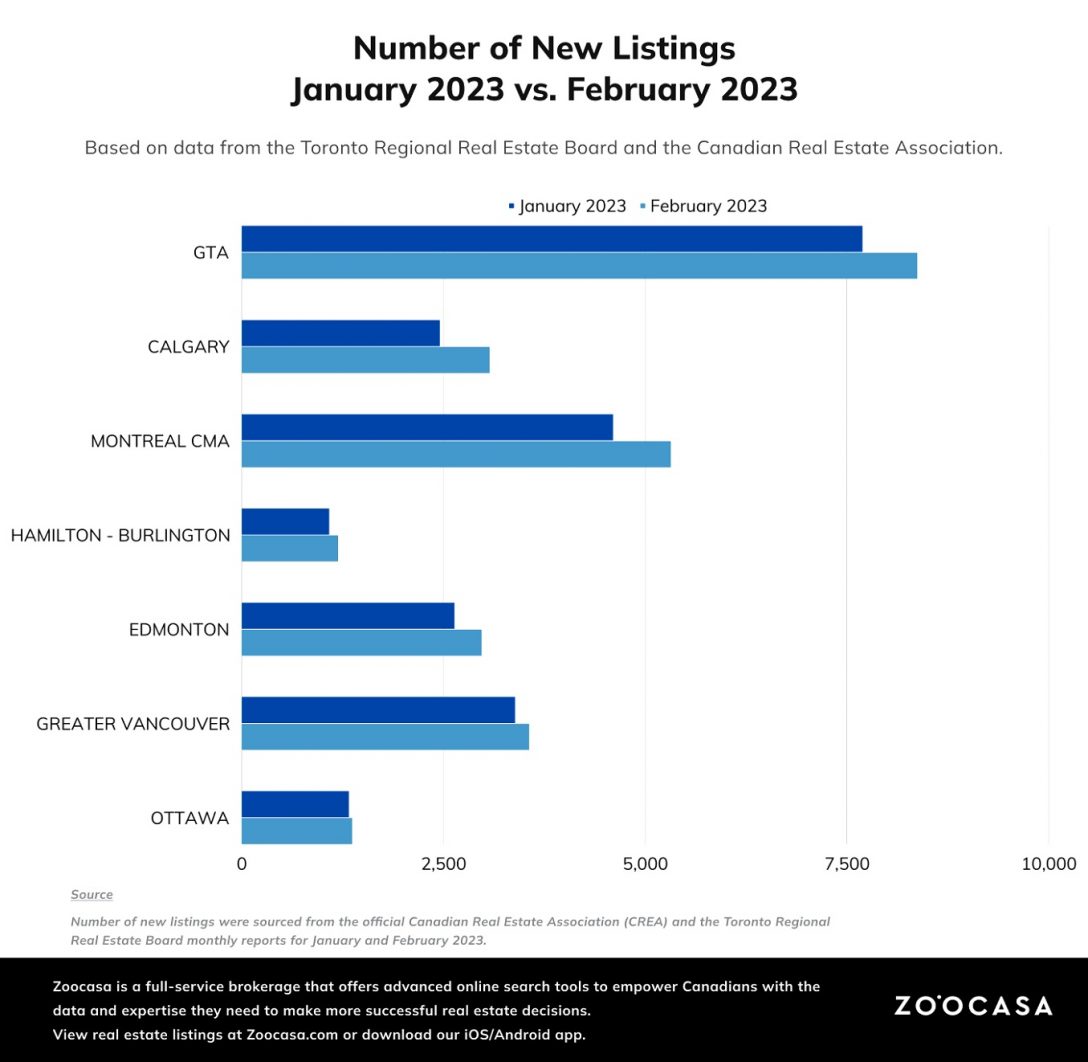

Last month, the Toronto Regional Real Estate Board noted that the number of newly listed properties had increased by almost 9% month-over-month. New listings were also up in February in Calgary by 25.1% and 8.9% in Edmonton. Further echoing this prediction, Vancouver also saw a slight increase of 5.2% in new listings in February.

Though there will be a fairly good absorption rate, it’s still important for people who want top dollar to invest in professional staging, smart marketing, and hiring a hyperlocal real estate agent that can distill the facts for your specific neighbourhood and property type.

More Investors Will Sell Their Properties

Last year’s interest rate hikes put a toll on landlords, with many losing money because of high monthly mortgage payments. Despite 5-year mortgage rates coming down slightly last month, rates are still significantly higher than last year. “Investors may also become sellers bringing more listings to market as some of the new rates upon renewals will push their monthly cash flow into the negatives,” described Haw. In 2023, the rent increase limit is 2.5% in Ontario, and in British Columbia it’s only 2%, meaning many landlords are unable to cover their costs and may not have a choice but to put their properties up for sale.

In 2020, a homeowner that made a 10% down payment on a $910,290 home (the February 2020 Toronto average price) with a 3-year fixed rate rate of 3.94% over 25 years has a monthly payment of $4,416. With a new rate of 4.84%, that same homeowner will now pay $4,836, an increase of $420 per month and a $5,040 increase per year.

Sideline Buyers Will Have the Confidence They Need

Increased activity from investor sellers and urban centre sellers, combined with currently falling interest rates, will prop up inventory to help create more balanced market conditions. This should be an ideal time for buyers to come to market, however sellers will still need to put effort into attracting buyers to their properties.

According to the most recent data released by the Canadian Real Estate Association (CREA), national home sales in February rose 2.3% month-over-month, with the Greater Toronto Area and Greater Vancouver driving forward most of that activity. Other regions that saw significant home sales increases from January to February 2023 include Montreal CMA (67%), Kitchener-Waterloo (46%), Calgary (45%), and Niagara Region (42%).

Buyer Advantage for Fixer-Uppers

“We will see the continued trend of great move-in ready homes getting multiple offers, and homes that need work or have negative aspects, such as being located on a busy street or not having parking, sit on the market,” explained Haw. This will give fixer-uppers less competition and could also give buyers the opportunity to negotiate a more favourable price. This could be a good option for first-time buyers looking for affordability or for newcomers wanting to get into homeownership.

On the other hand, move-in ready homes will continue to see a fair amount of competition and demand. However, nothing is a guarantee and sellers who don’t want their properties to linger on the market should take time to properly prepare their home for listing – such as modernizing appliances, making repairs, and updating furnishings.

Spring Real Estate Predictions for Canadian Homebuyers by MacKenzie Scibetta | zoocasa

Recent Comments