For the past three years, the Canadian real estate market has seen both hot record-setting highs and chilling lows, the result of fluctuating pandemic restrictions, rising interest rates and shifts in buyer sentiments. But how drastically have conditions changed since the pandemic began?

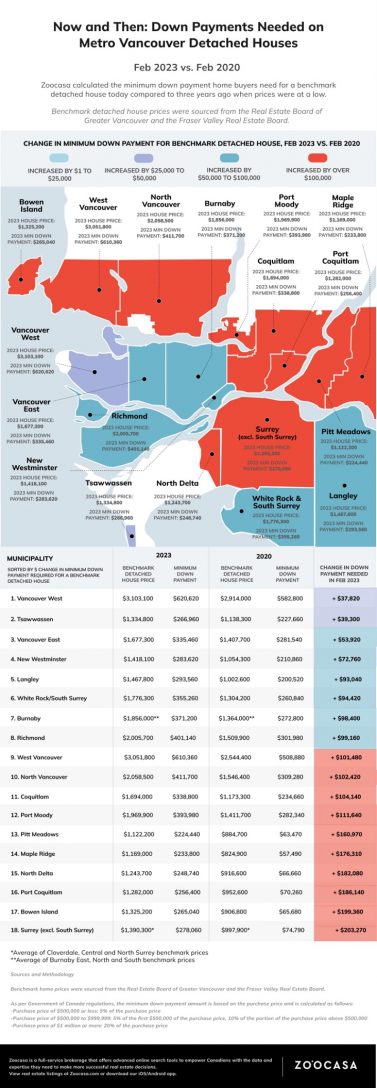

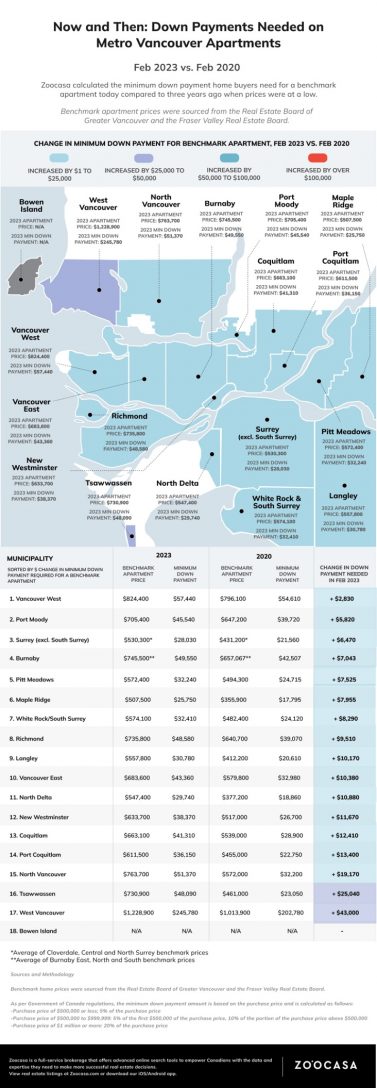

Before the spring market gets into motion, we wanted to find out how current down payment minimums in Metro Vancouver compare to those of three years ago, pre-pandemic, when prices were at a low. For this study, Zoocasa calculated the difference in the required down payment a buyer would need to purchase a benchmark-priced detached house or apartment in 18 municipalities across Metro Vancouver in February 2023 vs. the same time frame in 2020.

Benchmark home prices were sourced from the Real Estate Board of Greater Vancouver and the Fraser Valley Real Estate Board. Minimum down payment amounts were calculated based on 5% of the purchase price for homes valued at $500,000 and under, 10% for the portions of home prices between $500,001 – $999,999, and 20% for homes priced at $1 million and over.

Home Prices, Down Payments Surge Up Across Vancouver

According to the data, the benchmark price for detached houses for sale in Vancouver increased in every municipality between February 2020 – 2023, resulting in significantly larger down payments today. The largest increase was seen in Surrey, where benchmark house prices went up by 39% to $1,390,300 from under a million in 2020. Previously buyers in Surrey could benefit from a relatively lower down payment of $74,790, but the cost has risen steeply to more than $270,000.

Only two locations had increases under $50,000, Vancouver West and Tsawwassen, while the majority of areas saw raises of more than $100,000. However, despite these big changes, minimum down payment prices were generally more affordable in the areas with the largest increases. Take for example Pitt Meadows, which had the lowest minimum down payment on our list at $224,440, but compared with 2020, saw a sharp increase of $160,970. Maple Ridge and North Delta followed this pattern of holding a low position on our list while maintaining minimum down payments under $250,000.

Check out the infographic below to see how minimum down payment amounts have changed for benchmark detached houses between February 2020 – 2023.

Vancouver Apartment Prices Reach above $500,000

Affordable property types are gaining popularity across Canada as the cost of rent climbs, pushing benchmark apartment prices upwards. The same is true for Vancouver condos, though prices didn’t increase to the same extent as detached houses. All 18 municipalities saw benchmark apartment prices climb to over $500,000, leaving few properties with down payments under $30,000. For comparison, in 2020 10 out of 18 municipalities had apartments with a minimum down payment under $30,000, now that number is reduced to only 3: Maple Ridge, Surrey, and North Delta. Though it saw a $7,955 increase from 2020, Maple Ridge has the lowest minimum down payment in 2023 at $25,750. The lowest change in down payment needed belongs to Vancouver West, where the minimum down payment only increased by $2,830 – from $54,610 in 2020 to $57,440 in 2023.

On the more expensive end of the scale, a West Vancouver apartment bought at a benchmark price of $1,228,900, the highest on our list, would require the largest minimum down payment of $245,780. Interestingly, Tsawwassen, which had the second smallest change in down payment needed in the detached segment, had the third largest increase in change in down payment needed for a benchmark apartment.

Check out the infographic below to see how minimum down payment amounts have changed for benchmark apartments between February 2020 – 2023.

Here’s The Down Payment You’ll Need to Buy A House or Apartment in Metro Vancouver by MacKenzie Scibetta | zoocasa

Recent Comments