Housing prices have risen drastically in the last few years, and despite the small correction set about by the consistent interest rate hikes in the last 10 months, they remain quite high. In that time, wages have not risen at the same pace. The question is, are Canadian homes still affordable, and how much do you need to be earning to buy one?

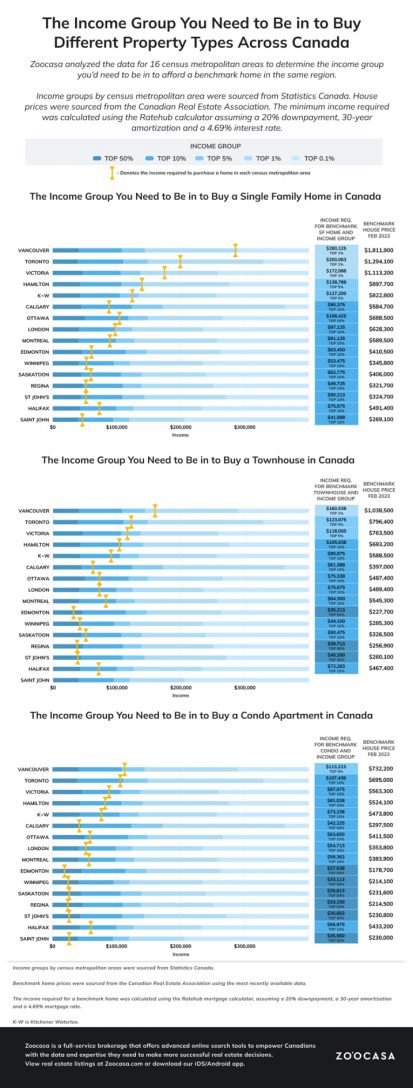

To find out, we analyzed 16 different census municipalities and compared the price for a single family, townhouse and condo apartment to different income groups, from the top 50% of earners to the top 0.1%. Affordability was gauged by determining how much income was needed to afford a home at the benchmark price which is reflected in the income groups in the infographic below.

Detached Affordability is Greatest in the Prairies and the East Coast

The data shows that homes in the Prairies and on the East Coast are more affordable than in Ontario or British Columbia. Buyers would need to be in the top 1% of earners to afford a single-family home in Vancouver, Toronto and Victoria. An income of $280,125 is required to afford a home at the benchmark price of $1,811,900 in Vancouver. However, at the other end of the scale, buyers in Montreal, Edmonton, Winnipeg, Saskatoon, Regina, St John’s, Halifax and Saint John would need to be in the top 10% of earners.

The townhouse chart tells a similar story. A prospective buyer would need to be in the top 50% of earners to buy a home in Edmonton, Regina or St John’s, but a buyer in Vancouver would require an income of $160,538 to afford a townhouse there, planting them firmly in the top 1% of earners.

For Edmonton, Winnipeg, Saskatoon, Regina, St John’s and Saint John, a prospective buyer of a condo apartment would need to be in the top 50% of earners to afford one. The highest income required to afford a home out of all of them is in Saskatoon, where an income of $35,518 would be able to afford a detached home. In Vancouver, on the other hand, a buyer would need to be in the top 5% of earners to afford an apartment, requiring an income of $113,213.

It is important to note that income scales differently in each city. So while someone in the top 10% of earners in St. John would need an income of $41,588 to afford a home there, in Ottawa, someone in the top 10% would need $106,425 to afford a home there. Housing prices being higher means that the cities with a greater median income will have both pricier income groups and higher required incomes.

The Income Bracket You Need to Be in to Buy A Home in These Canadian Cities by Daniel Crook | zoocasa

Recent Comments