Home prices are once again on the rise in Vancouver as interest rates have held steady since the last rate increase in January, according to the Real Estate Board of Greater Vancouver. In spite of mortgage rates being nearly double what they were this time last year, buyers are out in full force, causing demand and prices to grow.

Growing Demand is Propping Up Prices

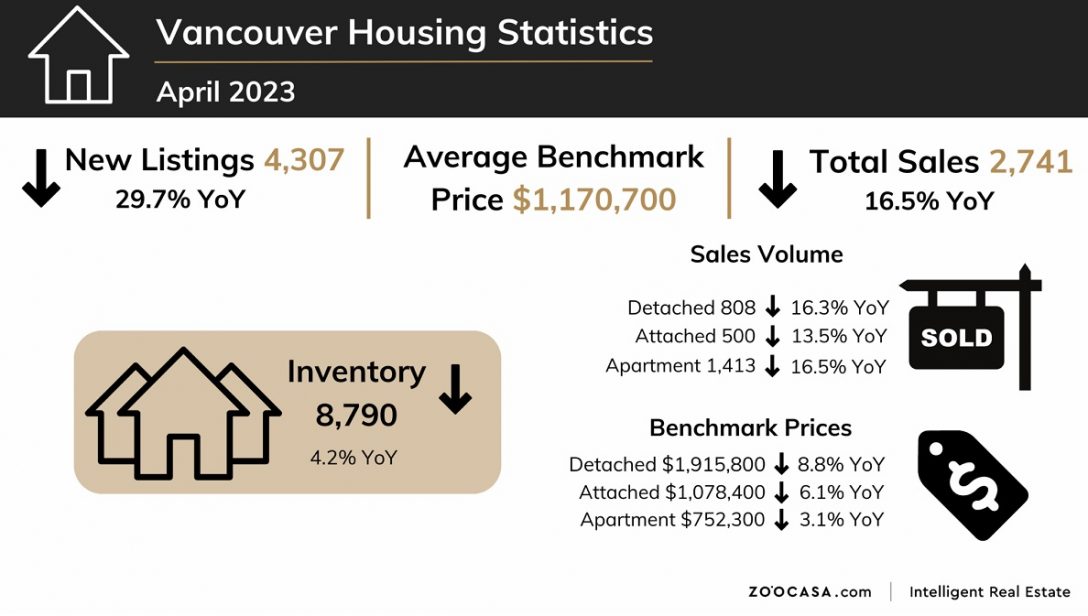

The benchmark home price in the city is now $1,170,700, up 2.4% month-over-month. Despite the steady price increase throughout this year so far, it is still down 7.4% from last year’s peak of $1,374,500, also set in April. Detached homes have experienced the highest price increase of all property types, edging up 2.9% year-over-year to $1,915,800. Part of the reason why home prices are on the rise is because of the severe lack of inventory, making competition hot.

There were just 4,307 homes listed for sale in April, down 29.7% year-over-year, and 22% below the 10-year average. Additionally, current inventory is 20.9% below the 10-year average with only 8,790 homes currently on the market, which is also down 4.2% from April 2022. Buyer confidence has returned while sellers still seem hesitant to put their properties up for sale, leading to greater competition in the market and price increases. Home sales are also well below the 10-year average down 15.6%, however the 2,741 homes that traded hands in April is up from the number of March sales by 8.1% from 2,535.

Prices Grew in All But One City in April

Benchmark prices have not increased everywhere in the Greater Vancouver Area. Port Moody is the outlier, with a 0.5% decrease month-over-month to $1,100,400. That comes purely from a decline in the price of detached houses, which fell by 1.8% to $1,981,400. The largest price increase came in Bowen Island, which shot up by 8.3% from March to $1,456,700.

Local markets are seeing the effects of heightened buyer interest in spite of the dwindling inventory. Many markets are currently favouring sellers, with a sales-to-new-listings ratio (SNLR) of over 60%. Port Coquitlam currently has an SNLR of 105%, for example, while Port Moody, despite the price decreasing in the last month, has an SNLR of 120%.

REBGV : Vancouver Prices Rise as Inventory Continues to Trend Below 10-Year Average by Daniel Crook | zoocasa

Recent Comments