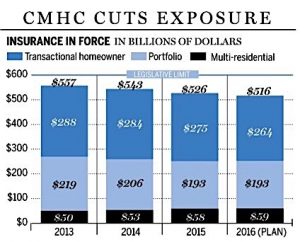

Canada’s national housing agency continues to decrease its exposure to the residential housing market, reporting a $6 billion drop the total insurance-in-force at the end of the first quarter of 2016. Canada Mortgage and Housing Corporation (CMHC) has been reducing that exposure since 2013, and has now cut it to $520 billion. The legislated ceiling for CMHC’s insurance-in-force is $6oo billion.

During the first quarter, 83,000 new residential mortgages were insured in Canada, the average insured amount being $242,367. The agency praised Canadian homebuyers, saying that they showed a “strong ability to manage their debts.” The average credit score for those seeking mortgage loans from CMHC was 747, which is quite good (the highest possible being 900).

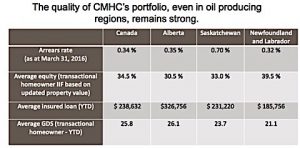

Another indicator of borrowers’ strength was the relatively low average gross debt service ratio (GDS) of 25.8%. This is the percentage of borrower’s income that is needed to pay all monthly housing costs, including mortgage payments, property taxes, heat and half of any condo fees. The standard maximum amount in Canada is 32%. On average, homeowners with CMHC-insured mortgages held 47 per cent equity in their homes.

Homebuyers with CMHC-insured mortgages have a strong ability to manage their debts as evidenced by an average credit score of 747 for transactional homeowner loans and an average gross debt service (GDS) ratio of 25.8% for the three-months ended March 31, 2016.

The arrears rate, indicating how many mortgage holders are having difficulties with their mortgages, remained within the historic range, at 0.34%, despite a small increase in arrears in Alberta and Saskatchewan.

Besides its residential mortgage insurance portfolio, CMHC also guaranteed $21.8 billion in new securities, divided between National Housing Act mortgage-backed securities MBS) and Canada Mortgage Bonds. These are investments backed by pools of insured mortgages intended to give investors access to the housing market, and to increase the supply of funds to the mortgage market. At the end of the first quarter, CMHC reports a total of $429 billion in guarantees-in-force. The securitization programs operate on a commercial basis without support from taxpayers.

CMHC also reports that it provided $589 million for housing programs on behalf of the Government of Canada in the first quarter.

CMHC Reports Continued Strength in Canada’s Housing Market, Mortgage Business by Josephine Nolan | Condo.ca

Recent Comments