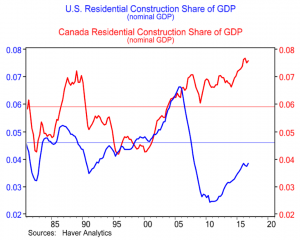

Residential construction has been making up a record share of Canada’s nominal GDP recently — and that’s a problem, suggests BMO.

Meantime, the Canadian economy’s increasing reliance on housing is elevated compared to where it stands in the US, a further sign of possible trouble ahead, adds the bank’s chief economist, Douglas Porter.

“Both the gap with the US and the level of activity are loud alarm bells for Canada’s market,” he writes in a note sent to clients this week.

Porter was not available for comment when BuzzBuzzNews called him recently to find out why, exactly, these points are cause for concern. But BMO Senior Economist Robert Kavcic took the call to explain.

“Residential construction goes through pretty clear multi-year-period cycles,” Kavcic tells BuzzBuzzNews. “Right now we’re obviously at the high end of what we’ve seen historically.”

Kavcic also agrees the economy right now is too reliant on residential construction activity, which accounts for about 7.5% of the national GDP and includes the building of new housing and reno projects as well.

In the US, residential construction is closer to making up 4% of the nation’s nominal GDP.

Kavcic says for Canada, roughly the long-run average of 6% of the GDP, would be a healthier share for construction to contribute to.

“But you do go through cycles obviously when housing stock is running quite a bit hotter to meet demand and then periods like the 1990s when we had Toronto and pretty much all of Ontario in a long, prolonged recession, especially in the housing market,” he adds.

Residential construction gains in terms of their share of the GDP since 2014 don’t necessarily reflect a surge in construction activity. “It’s actually been relatively stable,” Kavcic.

Rather, the pullback in energy sector has partly been responsible for heavier reliance on housing, he suggests. He also notes a lot of the recent strength has been coming from renovation spending.

“It is for sure reflecting an upgrading of older housing stock, those post-war single-detached bungalows that are getting upgraded or expanded,” he explains.

Canada’s Approaching A Downward Housing Cycle, Bank Suggests by Josh Sherman | Buzz Buzz Home

Recent Comments