At long last the Canadian housing market appears to be shaking off the effects of the mortgage stress test.

National home sales increased 4.2 percent in April on a year-over-year basis, according to Canadian Real Estate Association numbers published today.

BMO Chief Economist Douglas Porter notes the significance of the pickup in activity, which was also up 3.6 percent from the previous month.

“With the back-to-back gains, sales pushed 4.2% above year-ago levels, the first such increase since the stress test changes were brought in at the start of 2018,” Porter writes in a response to the CREA data.

“Overall, today’s results are a tad better than expected, and reinforce the view that the housing market looks to be stabilizing after the wave of policy changes in recent years, and with a return to milder weather,” he continues.

In January 2018, the federal government introduced stress testing for uninsured mortgages, following a similar policy for the insured segment that originated in 2016.

Under the new stress test, a homebuyer who can cough up a downpayment of at least 20 percent — the minimum for an uninsured mortgage — still has to qualify at a rate that is 200 basis points above what their federally regulated lender is offering.

The policy change hampered the market as it created a higher barrier to homeownership and, as with any new rule, added uncertainty.

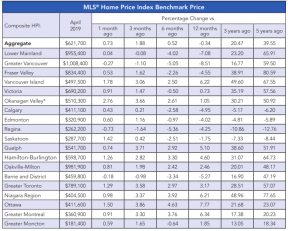

But now, as home sales activity picks up, prices are also increasing. The benchmark price of a Canadian home was $621,700 in April, up 0.7 percent from March and 0.5 percent from six months ago. The benchmark is still down 0.3 percent compared to April 2018, however.

“We continue to contend that prices, sales and starts are likely to hold broadly stable nationally in 2019 amid the many moving parts for the market,” says BMO’s Porter. “It’s no bad thing that the Canadian housing market is finally lacking in drama, especially given the surplus of drama elsewhere these days.”

Here’s how prices have changed in major markets across the country :

Canada’s Housing Market is Finally Recovering from The Mortgage Stress Test by Josh Sherman | Livabl

Recent Comments