Canadian home sales in May posted the largest annual increase in any month since federal policymakers introduced stress testing for uninsured mortgages in January 2018, notes BMO Chief Economist Douglas Porter.

“Canadian home sales continue to slowly gather renewed strength,” writes Porter in a response to the latest numbers from the Canadian Real Estate Association (CREA), which showed national home sales were up 1.9 percent in May compared to April and 6.7 percent annually.

The year-over-year increase was the largest recorded in the past three years.

Home prices remain tepid, but they could soon heat up as well, Porter suggests. “Past softness in the market is still holding prices in check, but sales activity leads prices, so that may change,” he says.

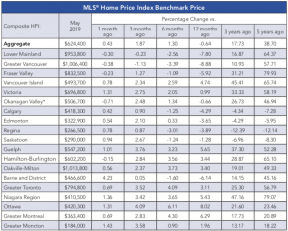

The benchmark price of a Canadian home, including condo apartments and houses, was $624,400 in May, up 0.4 percent from April but down 0.6 percent on a year-over-year basis.

While the Canadian housing market flexed its muscles last month, challenges still remain, suggests Gregory Klump, CREA’s chief economist.

“The mortgage stress-test continues to present challenges for home buyers in housing markets where they have plenty of homes to choose from but are forced by the test to save up a bigger down payment,” says Klump in a statement.

The introduction of stress testing for uninsured mortgages last year meant that home buyers could no longer avoid more stringent qualifying rules by putting forward a downpayment of 20 percent or more.

Previously, only insured mortgages (homebuyers who can’t cobble together a 20-percent downpayment must obtain mortgage insurance) were subject to stress testing.

The newer stress tests require a borrower to qualify at a rate that is 2 percentage points higher than what their lender is offering on the contract.

Many in the real estate industry have called for changes to the stress tests, such as lowering the threshold and waving the rules if a borrower wants to switch lenders upon renewal. CREA is among the groups calling for change.

“Hopefully the stress-test can be fine tuned to enable home buyers

to qualify for mortgage financing sooner without causing prices to shoot up,” says Klump.

Here’s how markets performed across Canada last month :

Canadian Home Sales Just Had Their Best Month Since Strict New Mortgage Rules Took Effect by Josh Sherman | Livabl

Recent Comments