A tentative market pushed the dollar volume of Metro Vancouver land sales in 2019’s first half down a whopping 70% year over year, according to the Vancouver Flash Report from Altus Group, published November 15.

The number of transactions in the first six months of the year more than halved, from 477 in H1 2018 to 210 in H1 2019. Combined with a decline in the average value of those transactions, the dollar volume was pulled down 70% from more than $3bn in the first half of 2018 to $919 million in 2019 (see graph above).

The report also noted that land sales throughout 2018 were 16% lower than the full year sales of 2017.

Industrial Sector

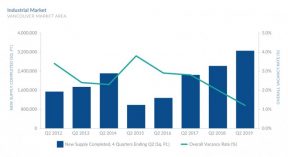

It was a very different story in the region’s industrial sector, which continues to be a scorching market. Altus reported that nearly 3.3 million square feet of new industrial space came on stream in the four quarters ending Q2 2019 — far above the annual average of about 1.8 million square feet, but still not enough to meet demand. The industrial vacancy rate fell to a super-tight 1.2% in mid 2019.

Rising demand for Metro Vancouver industrial space pushed down the vacancy rate, even though supply increased. Source : Altus Group.

Some easing of this vacancy rate may be on the horizon, with 4.1 million square feet of industrial space currently under construction, which is about 18 months’ worth of supply based on recent market conditions, said Altus.

However, the report added, “Vancouver industrial tenants typically face higher net rental rates for industrial space than other Canadian markets, and with very low vacancy rates, it can be expected that upward pressure on rents will continue.”

Office Market

The office sector also remains extremely tight in terms of vacancies, with supply in the four quarters ending in Q2 2019 also failing to meet demand. During that period only 500,000 square feet of space added to the Metro Vancouver market, which was one-third the amount of three years ago, Altus reported. It added, “The office vacancy rate is at its lowest level since 2008 at 4.4%.”

Altus observed that the demand has “spurred renewed interest in developing office space. At mid year 2019, there was about six million square feet of office space under construction in the Vancouver Market Area, of which just over half is already leased.”

The report also noted that three-quarters of this under-construction space is in downtown Vancouver. Downtown Vancouver has “not seen any completed space added in over a year, which helped drive the [downtown office] vacancy rate below 3% in mid 2019.”

Download the full report, which also examines retail property sales, new home development and homebuyer sentiment.

Metro Vancouver Land Sales Plummet 70% in 2019’s First Half by Joannah Connolly | Glacier Media Real Estate | Business in Vancouver

Recent Comments