A mortgage term is the length of time a buyer is locked in to a certain mortgage with a specific lender at its rate and conditions. Each type of term has its pros and cons, so it’s important for you to consider your own financial situation when choosing one.

Short-term vs Long-term

Your risk tolerance and plans for the future come into play when choosing between a short-term and long-term mortgage rate. A shorter term locks in your rate for a short period of time and is therefore more vulnerable to rising interest rates in the near future but allows for more flexibility if you were planning a move, for example. A longer term can be a fit if you’re planning to stay in your home for at least as long as your mortgage term, but you’re likely to pay a higher mortgage rate as five-year rates are almost always higher than one-year rates. With any mortgage, you may have to pay a significant penalty fee should you have to break your mortgage term early.

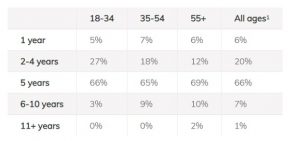

Popularity of Mortgage Term Length By Age

Tip : The length of your mortgage term directly affects the interest rate. Because long-term mortgage rates are more protected from interest rate changes, you pay a premium. This means that shorter terms tend to have lower rates.

When selecting a rate, pick the term that is best for you and your family. Here are a few example scenarios to give you an idea of what to think about :

• The Nomad : If you’re someone who moves often, or you know you’re going to move out of the home you’re purchasing in the near future, a short term could make the most sense.

• The Inheriter : If you believe you’re coming into a large sum of money in the not-so-distant future—an inheritance, a settlement, a large bonus—it could also make sense to go for a short-term mortgage if you plan to pay off a portion of the mortgage.

• The New Canadian : If you’ve just arrived in Canada you may not have the required Canadian credit to get a low-rate, long-term mortgage. In this case, you can go with a one-to-three-year higher rate, and renew your mortgage when you’ve built the required credit to get the mortgage rate you want.

• The Credit Builder : If you have damaged credit, you can still get a mortgage, but the rate will be higher. Like someone who’s new to Canada, you can get a short-term mortgage—up to three years—to achieve the credit you need. You need to find out or estimate how long it will take to bring your credit up to the desired mark, then choose a short-term mortgage that matches your needs. These rates are typically 1.50% to 2.50% higher, and lenders tend to want 24 months of smooth sailing, so two-year higher rate mortgages are most common in this scenario.

Fixed or Variable?

You’ll also need to look at fixed versus variable rates when choosing your term. Your mortgage type goes hand-in-hand with your mortgage term. A fixed rate stays the same for the duration of your term, whereas a variable rate changes with the prime lending rate set by your lender.

What You Should Know About Qualifying for a Mortgage

Lenders use two ratios to determine how much you can borrow for your mortgage: your Gross Debt Service and your Total Debt Service ratios. These include many important factors, such as annual income, condo fees, property taxes, outstanding debt and payments, and more.

There are also other rules that come into play. For example, in 2010, Finance Minister Jim Flaherty introduced new policy on mortgage terms: if you choose a short-term mortgage between 1 and 4 years, or any variable rate mortgage, you must qualify at a 5-year posted rate. This is to ensure that when you renew, you will still be able to afford a higher rate if rates have increased, as your mortgage payments would increase with them.

Breaking Your Mortgage Term

There are times when you have to break your mortgage term—you decide to sell your home or refinance. Keep in mind that if you have to break your term early, you will likely incur a prepayment penalty fee.However, instead of breaking your term, you can also look into porting your mortgage to your next home or have it assumed by the buyer of your current home. Read our page on porting or assuming your mortgage to learn more.

How to Select The Right Mortgage Term? by zoocasa

Recent Comments