The process to buy a home can be a challenging one. When you’ve finally found your dream home, you’ll most likely be thinking about how you’ll furnish the living room or which paint colours to choose. While the closing date means you get possession of your new home, you still need to take care of the expenses.

Closing costs are paid upfront when someone closes on a property in Canada. These costs can include the down payment, land transfer tax, legal fees, title insurance, and other miscellaneous costs.

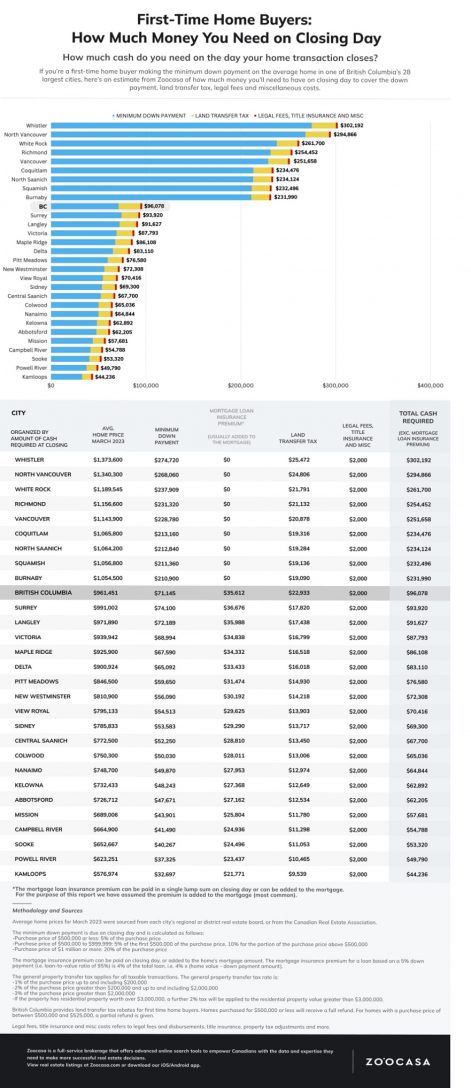

To help first-time homebuyers better understand what they should expect to pay on closing day, we compiled estimates based on average home prices in 28 major markets across British Columbia. Calculations assume the minimum down payment is made (and includes the initial deposit amount), that all land transfer tax (LTT) rebates for first-time home buyers have been applied, and that mortgage default insurance costs have been rolled into the mortgage, and hence do not need to be paid on closing day.

How Much will Buyers Pay on Closing Day Across British Columbia?

Generally speaking, buying in the more expensive cities will require a larger closing cost payment due to the size of the down payment. Buyers in Whistler will pay the most, with an expected closing cost of $302,192 on a home at the average price of $1,373,600. The $274,720 down payment contributes to this the most.

In all nine cities where a home costs over an average of $1,000,000, you can expect to see closing costs of over $200,000. Burnaby has the lowest average price of these cities, at $1,054,500, with a minimum down payment of $210,900, resulting in closing costs of around $231,990.

While there are many cities with prices below the British Columbia average of $961,451, there are only four that we covered below the national average of $686,371. Buyers looking for the greatest affordability will want to explore Campbell River, Sooke, Powell River and Kamloops. Campbell River has an average price of $664,900, requiring a down payment of $41,490 with a final closing cost of $54,788. Powell River has closing costs below $50,000, at just $49,790, resulting from a home at a price of $623,251. Kamloops is the most affordable with a home price of $576,974, meaning closing costs of $44,236.

Take a look at the infographic below to see how estimated closing costs range across British Columbia for first-time home buyers if they were purchasing the average-priced home in each city.

Closing Costs for First-Time Home Buyers in British Columbia by Daniel Crook | zoocasa

Recent Comments